Introduction

In this article Cheapest Car Insurance in Jacksonville, Florida, we will explore strategies for securing the cheapest car insurance in Jacksonville, considering both local nuances and broader industry insights. Car insurance, a financial safety net for drivers, is an indispensable aspect of responsible vehicle ownership. In Jacksonville, Florida, finding affordable coverage can be a challenge due to various factors that influence insurance rates.

Definition of Car Insurance

Car insurance is more than just a legal requirement; it’s a shield against financial burdens resulting from accidents, theft, or other unexpected events. Understanding its significance is crucial for making informed decisions about coverage.

Importance of Affordable Car Insurance

Affordability is key, especially in a city like Jacksonville, where the cost of living can impact residents’ budgets. Finding the right balance between cost and coverage is essential for every driver.

Factors Influencing Car Insurance Rates in getting Cheapest Car Insurance in Jacksonville, Florida.

Driving Record

One’s driving history significantly affects insurance rates. Clean records often result in lower premiums, while traffic violations can lead to increased costs.

Vehicle Type and Age

The make, model, and age of a vehicle influence insurance rates. Older, less expensive cars often cost less to insure, while luxury vehicles may come with higher premiums.

Location

Living in Jacksonville brings unique challenges, such as weather conditions and traffic patterns. Insurance rates can vary based on the local risk factors.

Understanding Jacksonville, Florida

Demographics

Understanding the demographics of Jacksonville helps drivers tailor their insurance needs to their specific circumstances as it affects getting Cheapest Car Insurance in Jacksonville, Florida.

Unique Driving Challenges

Jacksonville’s urban layout and traffic congestion add layers of complexity to driving. Considering these challenges is essential when selecting the right coverage.

Navigating Car Insurance Regulations in Florida

State Requirements

Understanding Florida’s minimum insurance requirements is the first step toward compliance. Knowing what’s mandatory helps drivers build a baseline policy.

Additional Coverage Options

Beyond the basics, exploring additional coverage options provides a comprehensive safety net. We delve into the extra protections that might be beneficial for Jacksonville residents.

Tips for Finding the Cheapest Car Insurance

Comparison Shopping

Shopping around is a fundamental step in finding affordable coverage. We discuss effective ways to compare quotes and identify the best deals.

Bundling Policies

Bundling home and auto insurance can lead to significant savings. Exploring multi-policy discounts is a smart strategy for Jacksonville residents.

Taking Advantage of Discounts

From safe driving discounts to loyalty rewards, uncovering available discounts can substantially lower insurance costs. We explore the various discounts offered by insurers in the area.

Local Insurance Providers in Jacksonville

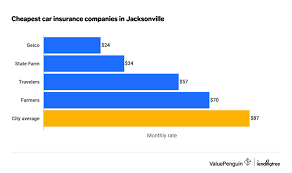

Overview of Providers

Examining local insurance providers is crucial. We provide an overview of notable insurers in Jacksonville, highlighting their strengths and specialties.

Customer Reviews and Ratings

Real experiences from fellow Jacksonville residents offer valuable insights into the quality of service provided by local insurance companies.

Balancing Cost and Coverage

Assessing Personal Insurance Needs

Understanding individual insurance needs is essential. We guide readers in evaluating their unique circumstances to determine the coverage that suits them best.

Avoiding Unnecessary Coverage

Cutting unnecessary coverage helps save money without compromising protection. We provide tips on identifying and eliminating redundant policies.

Importance of a Good Credit Score

Impact on Insurance Rates

A good credit score can positively impact insurance rates. We explore the correlation between credit scores and premiums.

Tips for Improving Credit Score

For those looking to enhance their credit standing, actionable tips are provided to help secure lower insurance rates.

The Role of Deductibles

Understanding Deductibles

Deductibles play a vital role in determining out-of-pocket expenses. We explain the concept and its impact on overall insurance costs.

Choosing the Right Deductible

Guidance is offered on selecting the optimal deductible, striking the right balance between immediate expenses and long-term savings.

Addressing Common Misconceptions about Car Insurance

Full Coverage Myth

The notion of “full coverage” is often misunderstood. We clarify what this term truly entails and whether it’s the right choice for Jacksonville drivers.

Impact of Vehicle Color on Rates

Dispelling the myth that vehicle color influences insurance rates, we highlight the actual factors that insurers consider.

Case Studies: Real Stories, Real Savings

Examples of Cost-Effective Insurance Solutions

Real-life stories illustrate how Jacksonville residents have found affordable insurance without sacrificing coverage.

Learning from Others’ Experiences

By learning from others’ experiences, readers can gain practical insights into effective cost-saving strategies.

Staying Informed: Keeping Up with Policy Changes

Regularly Reviewing Policies

Policies and regulations change over time. We stress the importance of regularly reviewing policies to ensure they align with current needs and standards.

Staying Updated on State Regulations

Jacksonville residents need to stay informed about any changes in Florida’s insurance regulations. We provide resources for staying updated on the latest developments.

Technology and Car Insurance

Usage-Based Insurance

Innovations in technology have given rise to usage-based insurance, where premiums are determined by actual driving habits. We explore how embracing these technologies can lead to more personalized and cost-effective coverage.

Apps for Monitoring Driving Habits

Smartphone apps that monitor driving habits are becoming increasingly popular. We discuss the benefits of using these apps and recommend some reliable options for Jacksonville drivers.

Making the Switch: Easy Steps to Change Insurers

Assessing Current Policy

Before making a switch, understanding the existing policy is crucial. We guide readers through the process of assessing their current coverage to identify gaps and redundancies.

Transitioning Smoothly

Changing insurers doesn’t have to be complicated. We provide a step-by-step guide to help Jacksonville residents transition smoothly to a new insurance provider.

Conclusion

Finding the Best Deal: Your Key to Affordable Car Insurance in Jacksonville

In conclusion, securing the cheapest car insurance in Jacksonville demands a strategic approach. By understanding the unique factors influencing rates in this city and leveraging smart financial practices, drivers can find coverage that meets their needs without breaking the bank.

Remember, the key lies in a combination of factors, from maintaining a clean driving record to taking advantage of available discounts. By staying informed, assessing personal needs, and making informed decisions, Jacksonville residents can navigate the complex world of car insurance with confidence.

Now, it’s your turn to take action. Explore your options, compare quotes, and make the choices that align with your budget and coverage requirements. Your journey to affordable car insurance starts now.

FAQs

- Q: Can my credit score really impact my car insurance rates? A: Yes, a good credit score can lead to lower insurance premiums as it is often seen as an indicator of financial responsibility.

- Q: Is full coverage necessary, or can I opt for a more budget-friendly option? A: The necessity of full coverage depends on individual circumstances. We break down the factors to consider when making this decision.

- Q: How often should I review my car insurance policy? A: Regular reviews, at least annually, are recommended to ensure your policy aligns with your current needs and to take advantage of new discounts.

- Q: Are there specific discounts available for Jacksonville residents? A: Local insurers may offer region-specific discounts. We highlight some common discounts that Jacksonville residents can explore.

- Q: Can I really save money by using a driving habits monitoring app? A: Yes, many insurance companies offer discounts for using apps that monitor driving habits. We discuss the benefits and some popular apps to consider.