Introduction

Using a Car Insurance Comparison Tool is not just a matter of convenience; it’s a strategic approach to finding the best coverage at the most competitive rates. As the world of insurance continues to evolve, these tools will likely play an even more significant role in helping consumers navigate the complexities of the industry.

Car insurance is a necessary investment for every car owner, providing financial protection in case of accidents, theft, or other unforeseen events. However, the process of selecting the right insurance policy can be overwhelming, given the multitude of options available. This is where car insurance comparison tools come to the rescue.

Definition of car insurance comparison tools

Car insurance comparison tools are online platforms that allow users to compare different insurance policies based on their specific needs and preferences. These tools simplify the complex task of navigating through various policies, helping users make informed decisions.

Importance of choosing the right car insurance

Selecting the right car insurance is crucial for ensuring adequate coverage and avoiding unnecessary expenses. A comprehensive policy not only protects the vehicle but also provides peace of mind to the car owner.

The Need for Comparison

A. Diverse insurance offerings

Insurance companies offer a wide range of policies, each with its unique features and coverage options. Car insurance comparison tools enable users to explore this diversity efficiently.

B. Varied coverage options

Understanding the different coverage options is essential for tailoring the insurance policy to individual needs. Comparison tools make it easy to identify policies that match specific requirements.

C. Price differentials

Car insurance premiums can vary significantly among providers. Comparison tools help users find the best value for their money by highlighting the price differentials.

Key Features to Look For

A. User-friendly interface

The best car insurance comparison tools boast an intuitive and user-friendly interface. Navigating through the tool should be a seamless experience for users of all technical backgrounds.

B. Coverage customization

Customization is key when it comes to insurance. Tools that allow users to tailor coverage based on their unique needs ensure a more personalized and relevant insurance policy.

C. Real-time quotes

Access to real-time quotes is a game-changer. The ability to instantly compare quotes from multiple providers gives users the advantage of making timely and well-informed decisions.

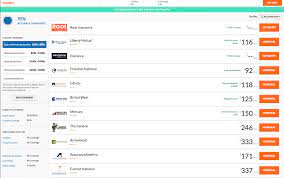

Top Car Insurance Comparison Tools

A. Tool A: Features and Benefits

Tool A stands out for its comprehensive coverage options and user-friendly interface. The tool provides a detailed breakdown of each policy, making it easy for users to compare and contrast.

B. Tool B: How it Stands Out

Tool B distinguishes itself through its advanced customization options. Users can tweak various aspects of their coverage, ensuring they only pay for what they need without sacrificing protection.

C. Tool C: Pros and Cons

An unbiased evaluation of Tool C’s pros and cons helps users understand its strengths and limitations, aiding in the decision-making process.

How to Use Car Insurance Comparison Tools Effectively

A. Entering accurate information

Accuracy is paramount when using comparison tools. Users should provide precise details about their vehicle, driving history, and coverage preferences to receive the most relevant quotes.

B. Understanding the results

Interpreting the comparison results requires a basic understanding of insurance terminology. The article will guide users on how to decipher the information and make sense of the various policy details.

C. Navigating through policy details

Once users have narrowed down their options, understanding the fine print is crucial. The article will offer tips on reviewing policy details to ensure there are no surprises later on.

Common Mistakes to Avoid

A. Overlooking hidden fees

Comparison tools may not always reveal hidden fees initially. The article will shed light on common hidden charges and how users can identify and avoid them.

B. Ignoring customer reviews

Real experiences from other users can provide valuable insights. The article will emphasize the importance of reading customer reviews to gauge the overall satisfaction with a particular insurance provider.

C. Focusing solely on the premium cost

While the premium cost is a significant factor, it should not be the sole determinant. The article will caution against making decisions based solely on price, encouraging users to consider the overall value of the policy.

Real-Life Success Stories

A. Testimonials from users who saved money

Sharing success stories of users who saved money using car insurance comparison tools adds a human touch to the article, making it more relatable and encouraging for readers.

B. Positive experiences with claims processing

Efficient claims processing is as important as choosing the right policy. Highlighting positive experiences with the claims process reinforces the reliability of the recommended tools.

Future Trends in Car Insurance Comparison

A. Technological advancements

Discussing upcoming technological trends in car insurance comparison tools gives readers a glimpse into the future of this industry.

B. Integration with smart devices

Exploring how comparison tools may integrate with smart devices for a more seamless user experience aligns with the evolving trends in technology and insurance.

C. Predictive analytics

The article will touch upon how predictive analytics may play a role in the future of car insurance comparison, offering users more accurate predictions and personalized recommendations.

The Ethical Dimension

A. Ensuring data privacy

Privacy concerns are paramount in the digital age. The article will discuss how reputable comparison tools prioritize and safeguard user data.

B. Transparency in affiliate relationships

Disclosing any affiliations with insurance providers ensures transparency. The article will stress the importance of choosing tools that maintain an ethical approach to affiliations.

Conclusion

A. Recap of benefits

Summarizing the benefits of using car insurance comparison tools reinforces the article’s main points and encourages readers to consider this approach.

B. Encouragement to explore options

A call to action urging readers to explore their options through reputable comparison tools adds a proactive element to the conclusion.