Introduction

Car insurance is a financial safeguard that provides peace of mind for drivers. However, the baffling phenomenon of car insurance premiums increasing without apparent cause has left many policyholders scratching their heads. In this article, we’ll unravel the complexities behind this issue, exploring factors that influence premium changes, understanding the role of insurance companies, and empowering consumers to make informed choices.

Definition of Car Insurance Premiums

Car insurance premiums are the periodic payments policyholders make to maintain coverage. Understanding the factors influencing these payments is crucial for all drivers.

Significance of Understanding Premium Changes

Inexplicable premium increases can be frustrating. Delving into the reasons behind such hikes is essential for informed decision-making and financial planning.

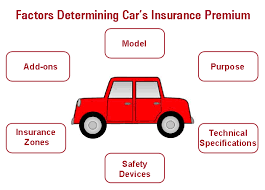

Factors Influencing Car Insurance Premiums

Driving Record

A clean driving record is often rewarded with lower premiums. However, even minor infractions can lead to unexpected hikes.

Vehicle Type and Age

The type and age of your vehicle play a significant role. Newer models and certain types may attract higher premiums.

Location and Geography

Your geographical location affects premiums due to factors like crime rates, traffic density, and weather conditions.

Coverage Levels

Adjusting coverage levels can impact premiums. Understanding your coverage needs is crucial for finding the right balance.

Mysterious Premium Hikes: A Common Dilemma

Car insurance, a financial safety net for drivers, often comes with a perplexing puzzle—mysterious premium hikes. These unexplained increases can leave policyholders scratching their heads and searching for answers. In this section, we delve into the enigma of why car insurance premiums seem to go up for no apparent reason, exploring the intricacies and common dilemmas faced by drivers.

Identifying Unexplained Premium Increases

The frustration of receiving a notice stating your car insurance premiums are increasing without a clear explanation is not uncommon. Identifying the factors contributing to these hikes requires a thorough examination of your policy details. While some increases may be tied to specific risk factors, others might seem arbitrary at first glance.

Common Misconceptions

To unravel the mystery, it’s essential to dispel common misconceptions surrounding premium increases. Not every spike is without reason; understanding the factors at play can bring clarity. Misinterpretations often lead to frustration, and by debunking these myths, policyholders can approach the issue with a clearer perspective.

Myth 1: Insurance Companies Increase Premiums Arbitrarily

Reality: Insurance companies base premium changes on various factors, including changes in risk profiles, industry trends, and internal business strategies.

Myth 2: Premiums Increase After Every Claim

Reality: While claims can impact premiums, not every claim automatically results in an increase. Insurance companies consider various aspects, including fault, severity, and frequency of claims.

Myth 3: Loyalty to One Company Guarantees Stable Premiums

Reality: Loyalty is valued, but assuming stable premiums without periodically reviewing your policy may lead to missed opportunities for better rates.

Navigating the Uncharted Waters of Premium Changes

Understanding the dynamics of premium changes is crucial for policyholders. While some increases are within the realm of predictability, others might seem like a sudden storm on a clear day. By staying informed and proactive, drivers can navigate these uncharted waters more effectively.

Reviewing Policy Documents

Regularly reviewing your policy documents can provide insights into changes in coverage, deductibles, or terms that may contribute to premium increases.

Checking for External Influences

External factors such as changes in the local economy, state regulations, or even shifts in the insurance market can influence premium adjustments.

Consulting with Insurance Providers

When faced with unexplained premium hikes, reaching out to your insurance provider is a proactive step. Providers can offer clarification and discuss potential solutions.

Comparing Quotes from Different Insurers

Shopping around for quotes from different insurers can reveal competitive rates. Loyalty to one company may not always be rewarded with the most cost-effective premiums.

The Role of Insurance Companies

Risk Assessment Strategies

Insurance companies employ various risk assessment strategies, impacting premium calculations. Understanding these strategies is key.

Profit Margins and Business Tactics

Exploring the profit motives of insurance companies provides insights into the business dynamics affecting premiums.

Tips for Policyholders

Regular Policy Review

Regularly reviewing your policy ensures you are aware of any changes and can address concerns promptly.

Seeking Clarification from Insurance Providers

When faced with unexplained premium hikes, don’t hesitate to seek clarification from your insurance provider.

Shopping Around for Better Rates

Exploring other insurance options can uncover more competitive rates. Loyalty to a single provider may not always be cost-effective.

The Impact of Consumer Behavior

Loyalty vs. Switching Insurers

Examining the impact of consumer loyalty on premiums and exploring the benefits of switching insurers.

How Consumer Choices Affect Premiums

Understanding how your choices as a consumer directly impact your premiums.

Regulatory Measures and Consumer Rights

Legal Protections Against Arbitrary Increases

Understanding the legal protections in place can empower policyholders in challenging arbitrary premium hikes.

The Importance of Knowing Your Rights

Being aware of your rights as a consumer is essential for navigating the complex landscape of car insurance.

Real-Life Stories: Experiences of Policyholders

Personal Narratives of Unexpected Premium Changes

Sharing real-life stories of policyholders who experienced unexplained premium increases.

Lessons Learned and Advice Shared

Extracting valuable lessons and advice from the experiences of others.

The Future of Car Insurance Premiums

Technological Advancements in Insurance

Exploring how technological advancements may shape the future of car insurance premiums.

Potential Changes in the Industry

Anticipating industry shifts that could impact the way premiums are calculated and communicated.

Conclusion

Summarizing Key Takeaways

In this journey of unraveling the mysteries of car insurance premiums, understanding the factors, debunking myths, and knowing your rights emerge as crucial tools. Empowered with knowledge, you can navigate the insurance landscape with confidence.

Empowering Consumers with Knowledge

Knowledge is power. Empower yourself to make informed decisions, challenge unexplained hikes, and secure the coverage that aligns with your needs and budget.

In the maze of car insurance, mysterious insurance premiums hikes stand out as a common dilemma. By identifying unexplained increases, dispelling misconceptions, and actively navigating changes, policyholders can approach the situation with confidence. Understanding that insurance premiums are not arbitrary but based on a complex interplay of factors empowers drivers to make informed decisions and ensure their coverage remains both comprehensive and affordable.

FAQs

- Why do car insurance premiums go up for no reason?

- Premiums can increase due to various factors, including changes in driving records or insurance company policies. Understanding these factors is crucial.

- Can I dispute an unexplained premium increase?

- Yes, policyholders have the right to dispute unexplained premium hikes. Contact your insurance provider for clarification and resolution.

- How often should I review my car insurance policy?

- Regular policy reviews, at least annually, are recommended to stay informed about any changes and ensure your coverage meets your needs.

- Is loyalty to one insurance company cost-effective?

- Loyalty may not always result in the best rates. Shopping around and exploring different insurers can help find more competitive premiums.

- What role does technology play in the future of car insurance premiums?

- Technological advancements may lead to more personalized and dynamic premium calculations, impacting the future landscape of car insurance