Introduction

Car insurance Rate, a necessary safeguard for drivers, is often perceived as a complex puzzle when it comes to determining rates. One of the pivotal factors influencing these rates is age. In this comprehensive guide, we will unravel the intricacies of average car insurance rates by age, providing valuable insights and practical tips for drivers of all generations.

Car insurance rates, the financial heartbeat of the insurance industry, are the monetary expressions of the risk a driver poses to the insurer. Understanding the average rates becomes crucial for individuals seeking not only financial protection but also cost-effective solutions.

Factors Influencing Car Insurance Rates

While age is a primary factor, other elements like driving history, vehicle type, and location contribute significantly to the calculation of insurance rates. A holistic understanding of these factors is essential for anyone aiming to grasp the dynamics of car insurance costs.

Car insurance rates, the financial backbone of the insurance industry, are not one-size-fits-all. They vary based on a multitude of factors, and one of the primary influencers is age. In this article, we’ll delve into the intricate relationship between age and car insurance rates, exploring how different age groups may experience fluctuations in their premiums.

Understanding the Dynamics

Car insurance companies consider age as a crucial determinant when calculating insurance premiums. Different age groups are perceived to pose varying levels of risk, influencing the cost of coverage. Let’s dissect how these dynamics play out at different stages of life.

Teenagers and Young Drivers

1. Lack of Driving Experience: One of the primary factors contributing to higher insurance rates for teenagers is their limited driving experience. Insurance companies often view novice drivers as riskier, leading to elevated premiums.

2. Higher Accident Rates: Statistics show that younger drivers, particularly teenagers, are more prone to accidents. This increased risk directly impacts insurance rates, making them higher for this demographic.

3. Academic Performance: Surprisingly, academic performance can also influence insurance rates for young drivers. Many insurance providers offer discounts for students with good grades, aiming to encourage responsible behavior both on and off the road.

Middle-Aged Drivers

1. Stability and Experience: As drivers move into their mid-20s and beyond, insurance rates generally stabilize. The accumulation of driving experience and a more mature approach to road safety contribute to this stability.

2. Driving Record: The individual’s driving record plays a significant role in determining insurance rates during this phase. A clean record can lead to lower premiums, while traffic violations may result in increased costs.

3. Vehicle Type: The type of vehicle owned by a middle-aged driver can impact insurance rates. Family-friendly cars or mid-range sedans may attract lower premiums compared to high-performance or luxury vehicles.

Senior Drivers

1. Experience vs. Health Factors: While seniors often benefit from years of driving experience, health factors become more prominent in insurance calculations. Certain health conditions may be associated with higher risks, affecting insurance rates.

2. Limited Mileage Discounts: Many seniors drive less frequently than younger age groups. Some insurance providers offer discounts for low mileage, acknowledging that reduced time on the road correlates with a lower likelihood of accidents.

3. Shop Around for Discounts: Seniors should actively explore available discounts, such as safe driver discounts or bundled coverage options, to mitigate the impact of age-related factors on insurance rates.

Overview of Average Car Insurance Rates

Before delving into age-specific averages, it’s crucial to comprehend how insurance rates are calculated. National averages provide a baseline, but regional variations can introduce nuances that impact the final figures.

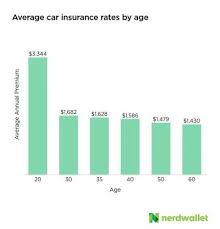

Average Car Insurance Rates for Young Drivers

For the younger demographic, especially teenagers, car insurance rates tend to be notably high. As age and driving experience increase, there’s a gradual decline in these rates. Exploring strategies for affordable coverage during this phase becomes imperative.

Middle-Aged Drivers and Insurance Rates

The mid-age range typically witnesses stability in insurance rates. However, factors like driving records and vehicle types can still influence the cost of coverage. This section provides insights for individuals navigating this phase of life.

Senior Drivers and Insurance Costs

Seniors, while often enjoying the benefits of experience, may face unique challenges in securing affordable coverage. Understanding the factors affecting rates for this demographic is essential, along with strategies to obtain cost-effective solutions.

Comparison Across Age Groups

Comparing average rates across different age groups unveils trends and patterns. Recognizing these distinctions can empower drivers to make informed decisions when selecting insurance coverage tailored to their age bracket.

Tips for Lowering Car Insurance Rates

Practical tips for lowering insurance rates are shared here, encompassing safe driving habits, vehicle selection, and exploring discounts or bundling options. These insights can benefit drivers of all ages.

The Role of Location in Insurance Rates

Geographical location plays a significant role in insurance rates. Urban and rural distinctions, along with state-specific variations, contribute to the overall landscape of car insurance costs.

How to Shop for Car Insurance by Age

Customizing coverage based on age is a savvy approach. This section guides readers on how to navigate the insurance market, utilizing online tools and resources to find the most suitable options.

Understanding Demographic Risk

From an insurance company’s perspective, age represents a demographic risk. This section sheds light on how insurers assess risk based on age and offers strategies for individuals to mitigate risk factors for better rates.

Technological Innovations in Insurance

The integration of technology, particularly telematics, is reshaping the insurance landscape. Drivers who embrace these innovations can enjoy benefits that extend beyond cost savings. This section explores the impact of technology on insurance rates.

Common Myths About Car Insurance Rates

Dispelling common misconceptions surrounding car insurance rates is vital for empowering consumers. Accurate information allows individuals to make informed decisions about coverage without falling prey to myths.

Future Trends in Car Insurance Rates

As the insurance industry evolves, so do the factors influencing rates. Predicting future trends provides readers with foresight, helping them make decisions that align with the dynamic landscape of the car insurance market.

Conclusion

In conclusion, understanding the average car insurance rates by age is a valuable asset for drivers seeking not only protection but also affordability. Navigating the diverse factors influencing rates allows individuals to make informed decisions tailored to their specific needs.

In conclusion, age is a pivotal factor influencing car insurance rates. Understanding how insurers perceive risk at different stages of life allows individuals to make informed decisions and take proactive steps to manage and potentially reduce their insurance costs. Whether you’re a teenager, a middle-aged driver, or a senior, being aware of the specific factors that affect your age group can help you navigate the complex landscape of car insurance more effectively. Remember, staying informed and regularly reviewing your coverage can lead to better financial outcomes in the long run.

FAQs

- Is car insurance more expensive for younger drivers?

- Yes, car insurance tends to be more expensive for younger drivers due to perceived higher risk.

- Do insurance rates stabilize during middle age?

- Generally, insurance rates show stability during the middle age range, influenced by driving records and vehicle types.

- Are there discounts available for senior drivers?

- Yes, many insurance providers offer discounts for senior drivers, but rates may vary.

- How can technology help lower insurance rates?

- Technology, such as telematics, can lower insurance rates by promoting safe driving habits and providing personalized data for insurers.

- What are some common myths about car insurance rates?

- Common myths include the belief that the color of the car affects rates and that insurance always gets more expensive with age.