Introduction

This article Define Workers: The 1 Key to a Successful Business will explore the concept of defining workers, the legal aspects involved, and why it matters to your business. In today’s rapidly changing work landscape, understanding the term “workers” and how to define them is essential for employers, employees, and business owners alike. The way we define workers can significantly impact our daily lives, from our employment relationships to tax responsibilities.

Understanding the Importance of Defining Workers

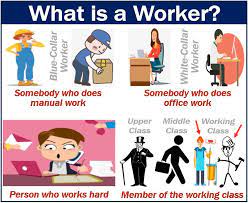

Who Are Workers?

Workers encompass a broad range of individuals engaged in various forms of employment. They can be full-time or part-time employees, freelancers, or independent contractors. Properly defining these roles is crucial in determining their rights and responsibilities.

The Legal Significance

Legally, the term “worker” holds different implications in various jurisdictions. It can affect employment contracts, tax obligations, and access to benefits. Understanding the legal significance is vital for both employers and employees.

The Relationship Between Employers and Workers

Types of Employment Contracts

To define workers accurately, it’s crucial to be aware of the different types of employment contracts. These can include permanent contracts, temporary contracts, freelance agreements, and more. Each type comes with its own set of rules and regulations.

The Role of Labor Laws

Labor Law Overview

Labor laws play a significant role in how workers are defined and protected. Understanding these laws is essential for both employers and workers. Labor laws differ from one region to another, and complying with them is vital for businesses.

Defining Workers: Why It Matters

Employee Benefits

Defining workers correctly can determine their eligibility for various benefits such as healthcare, retirement plans, and paid leave. Proper classification ensures that employees receive the perks they are entitled to.

Tax Implications

Taxation is another critical aspect of defining workers. Different classifications have varying tax implications, and both employers and employees must be aware of the financial consequences.

The Keyword: “Define Workers”

To better understand how to define workers, let’s explore the keyword: “Define Workers.” This keyword emphasizes the significance of correctly classifying employees and contractors.

Key Definitions and Concepts to Define Workers

Employee vs. Independent Contractor

Distinguishing between employees and independent contractors is essential, as it affects tax withholdings, benefits, and employment rights. This section will clarify the differences between the two.

Full-time vs. Part-time

Whether a worker is full-time or part-time can have significant implications on their benefits and legal rights. We’ll delve into the distinctions and how they affect both employees and employers.

How to Define Workers in Your Business

Defining workers accurately in your business involves understanding the legal frameworks and guidelines that apply to your industry and jurisdiction. This section will provide practical steps for employers.

Legal Compliance and Best Practices

Employment Classification Guidelines

This subsection will provide best practices and guidelines for employers to classify workers correctly and stay in compliance with labor laws.

Challenges in Defining Workers

Defining workers can be challenging due to evolving work arrangements and regulations. We will discuss the common challenges faced by employers and how to navigate them.

The Gig Economy and Its Impact

The rise of the gig economy has changed the landscape of work, making it even more crucial to define workers correctly. We’ll explore the gig economy’s impact on worker classification.

Case Studies on Define Workers

Real-life case studies will be examined to highlight the consequences of misclassifying workers and the legal ramifications faced by employers.

Practical Tips for Employers to Define Workers

This section will provide practical tips for employers on how to navigate the complexities of defining workers in the modern work environment.

Conclusion

In conclusion, defining workers accurately is vital for both employers and employees. It affects legal compliance, tax responsibilities, and access to benefits. Understanding these intricacies ensures a smoother and more ethical working environment.

In conclusion, the definition of workers is a fundamental aspect of the modern workforce, impacting legal compliance, financial responsibilities, and the well-being of employees. Proper classification ensures that workers receive the benefits and protections they deserve, while also helping employers navigate the complex regulatory landscape. Staying informed about labor laws and best practices is essential for a successful and ethical business operation.

FAQs

- What are the key differences between an employee and an independent contractor?When defining workers, one of the fundamental distinctions is between employees and independent contractors. Employees typically work under the direct control and supervision of the employer, who provides tools, equipment, and sets the work hours. They may be entitled to benefits such as health insurance, retirement plans, and paid leave.On the other hand, independent contractors are self-employed individuals who provide services to a client or company. They have more control over their work, set their own hours, and use their tools. Independent contractors are responsible for their taxes and do not receive traditional employee benefits.

- How do labor laws vary across different regions and jurisdictions?Labor laws are not universal and can vary significantly from one region to another. It’s essential for both employers and workers to be aware of the specific labor laws that apply to their location. These laws govern aspects like minimum wage, overtime pay, worker safety, and employee rights. Understanding and complying with local labor laws is crucial to avoid legal issues.

- What benefits are workers entitled to, and how are they affected by proper classification?Properly defining workers ensures that they receive the benefits they are entitled to. These benefits can include health insurance, retirement plans, paid vacation, and sick leave. In some cases, misclassification can lead to workers being denied these benefits, which can have a significant impact on their well-being.

- How has the gig economy changed the way we define and classify workers?The gig economy, characterized by short-term or freelance work arrangements, has transformed the traditional employer-employee relationship. This change has made it more challenging to define and classify workers accurately. Gig workers often fall into a gray area between employees and independent contractors, raising questions about their rights and legal protections.

- Can you provide an example of a real-life case where misclassifying workers had legal consequences?One well-known example of misclassifying workers is the case of Uber. In various jurisdictions, courts have ruled that Uber drivers should be classified as employees rather than independent contractors. This has led to legal battles and significant financial consequences for the company, including requirements to provide employee benefits and pay back wages.