Introduction

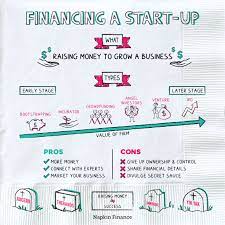

In this comprehensive guide, we’ll explore the diverse avenues available for Financing a Start-Up Business, offering insights, real-world examples, and practical tips to help you navigate the financial landscape successfully. Starting a new business is an exciting venture filled with possibilities, but one of the critical aspects that can make or break your entrepreneurial dreams is financing.

Embarking on the journey of entrepreneurship requires more than just a great idea; it demands adequate financial support. Whether you’re in the ideation phase or looking to scale up an existing venture, understanding the various financing options is crucial for sustained success.

Understanding the Cost of Financing a Start-Up Business

Before diving into financing options, it’s essential to grasp the intricacies of start-up costs. These can be broadly categorized into fixed and variable costs. Fixed costs, such as rent and salaries, remain constant, while variable costs fluctuate based on production and sales.

Bootstrapping: A DIY Approach in Financing a Start-Up Business

For many entrepreneurs, bootstrapping is the first port of call. This involves using personal savings and revenue generated by the business to fund operations. While it provides autonomy, it comes with challenges. We’ll explore the pros and cons, along with real-life examples of businesses that successfully bootstrapped.

Seeking Investors: A Vital Step in Financing a Start-Up Business

Investors play a pivotal role in fueling start-up growth. We’ll delve into the types of investors, including angel investors and venture capitalists, and provide valuable insights on preparing an enticing pitch to attract their attention.

Crowdfunding: The People’s Choice when Financing a Start-Up Business

In the digital age, crowdfunding has emerged as a popular financing option. We’ll demystify crowdfunding, discuss prominent platforms, and showcase success stories of ventures that found success through community support.

Small Business Loans: Navigating the Options

Securing a small business loan involves understanding the types available and meeting specific criteria. We’ll provide an overview of loan options, qualifications, and real-world case studies that illustrate the impact of strategic borrowing.

Government Grants and Subsidies an option in Financing a Start-Up Business

Governments often provide grants and subsidies to support budding businesses. We’ll outline available programs, guide you through the application process, and share success stories of businesses that flourished with government assistance.

Strategic Partnerships: Sharing the Load

Strategic partnerships can offer financial and operational support. We’ll define what makes a partnership strategic, explore the benefits for start-ups, and present examples of successful businesses that thrived through collaboration.

Creating a Comprehensive Business Plan when Financing a Start-Up Business

A well-crafted business plan is a cornerstone for attracting investors. We’ll emphasize the importance of a detailed plan, outline key components, and elucidate how it aids in securing the necessary financing.

Mitigating Risks: A Crucial Consideration while Financing a Start-Up Business

Every venture involves risks, and managing them is key to success. We’ll identify potential risks, offer strategies for risk management, and share anecdotes of start-ups that navigated challenges effectively.

Building Financial Projections

Financial projections provide a roadmap for sustainable growth. We’ll explore their role, guide you on creating realistic forecasts, and explain how solid financial projections can instill confidence in potential investors.

Scaling Up: Planning for Growth

The phase of scaling up requires careful financial planning. We’ll discuss the financial implications of growth, share insights on successful scaling strategies, and present case studies of well-funded start-ups that achieved remarkable expansion.

Common Pitfalls to Avoid in Financing a Start-Up Business

Learning from mistakes is integral to success. We’ll dissect common pitfalls that have led to the downfall of start-ups, offering valuable lessons and practical tips to avoid similar financial missteps.

Starting a business is an exhilarating journey, but the path to success is riddled with potential pitfalls, especially when it comes to securing financing. To ensure your start-up thrives, it’s crucial to be aware of and sidestep these common pitfalls:

1. Lack of Clear Financial Planning

One of the most significant missteps entrepreneurs make is diving into the start-up world without a well-defined financial plan. Without a roadmap for your finances, you risk overspending, miscalculating costs, and encountering unexpected financial challenges.

2. Underestimating Start-Up Costs

New entrepreneurs often underestimate the actual costs of launching and running a business. From licensing fees to equipment and initial marketing, it’s essential to thoroughly research and account for all potential expenses to avoid being blindsided by unforeseen financial burdens.

3. Ignoring the Importance of Credit

Your personal and business credit history can significantly impact your ability to secure financing. Neglecting to build and maintain a positive credit score can limit your access to crucial funding sources, hindering your start-up’s growth.

4. Overreliance on a Single Financing Source

Relying too heavily on one financing option can be risky. Whether it’s personal savings, a single investor, or a specific loan type, diversifying your funding sources provides a safety net if one avenue falls through.

5. Failing to Understand the Terms and Conditions

When securing financing, it’s imperative to read and comprehend all terms and conditions thoroughly. Hidden fees, high-interest rates, or unfavorable repayment terms can lead to financial strain down the line.

6. Poorly Defined Business Model

Investors and lenders want to see a clear and viable business model. Failing to articulate how your start-up will generate revenue and achieve sustainability can deter potential backers.

The Role of Mentors and Networking in Financing a Start-Up Business

Mentorship and networking can open doors to financial opportunities. We’ll highlight the importance of having mentors, share stories of successful mentorship, and discuss networking strategies for accessing financial support.

Conclusion

In conclusion, Financing a Start-Up Business is a multifaceted journey that demands strategic planning and informed decision-making. By exploring various financing options, understanding start-up costs, and learning from both successes and failures, entrepreneurs can pave the way for sustainable growth and success in the competitive business landscape.

FAQs

- Q: Can I secure financing without giving up equity in my start-up?

- A: Yes, options like small business loans and government grants allow you to secure funding without relinquishing equity.

- Q: How important is a business plan in attracting investors?

- A: A well-crafted business plan is crucial for attracting investors, providing them with a comprehensive view of your business and its potential.

- Q: What are the common pitfalls to avoid when financing a start-up?

- A: Common pitfalls include inadequate risk management, poor financial planning, and a lack of understanding of start-up costs.

- Q: How can networking contribute to securing financial support for my start-up?

- A: Networking connects you with potential investors, mentors, and collaborators, opening avenues for financial support and guidance.