Insurance Coverage Options: A Comprehensive Guide

Introduction

Insurance is an essential aspect of modern life, offering financial protection and peace of mind in times of unexpected events. This article will delve into the world of insurance coverage options, providing you with a comprehensive understanding of the types of insurance available, factors affecting premiums, and how to make informed choices.

Understanding the Basics of Insurance

Before exploring the various insurance coverage options, it’s vital to understand the fundamental concept of insurance. Insurance is a contract between an individual or entity and an insurance company. In exchange for regular premium payments, the insurer agrees to provide financial protection in case of specific events, such as accidents, illnesses, or damage to property.

Types of Insurance Coverage

Health Insurance

Health insurance is designed to cover medical expenses, ensuring that you receive necessary healthcare without worrying about the cost. It typically includes coverage for doctor visits, hospital stays, medications, and preventive care.

Auto Insurance

Auto insurance is a legal requirement for vehicle owners. It offers protection in case of accidents, theft, or damage to your vehicle. It also provides liability coverage if you cause harm to others or their property.

Home Insurance

Home insurance, also known as homeowner’s insurance, safeguards your home and personal belongings. It covers damages caused by fire, theft, vandalism, or natural disasters. Additionally, it includes liability coverage for accidents that occur on your property.

Life Insurance

Life insurance is a financial safety net for your loved ones. It pays out a sum of money (the death benefit) to your beneficiaries when you pass away. This ensures that your family is financially secure in your absence.

Travel Insurance

Travel insurance is a short-term policy that provides coverage during your trips. It includes benefits like trip cancellation, medical emergencies, and lost luggage protection.

Additional Coverage Options

Umbrella Insurance

Umbrella insurance offers an extra layer of liability coverage. It comes into play when your standard insurance policy’s limits are exceeded. It provides protection in cases of lawsuits, ensuring your assets are safeguarded.

Pet Insurance

Pet insurance covers medical expenses for your beloved pets. It includes veterinary bills, surgeries, and medications, helping you provide the best care for your furry friends.

Flood Insurance

Flood insurance is essential for those living in flood-prone areas. It covers damage caused by floods, which are typically not included in standard home insurance policies.

Disability Insurance

Disability insurance provides income replacement if you are unable to work due to a disability. It ensures that you can continue to meet your financial commitments during a period of incapacity.

Business Insurance

Business insurance is crucial for entrepreneurs. It includes various types of coverage, such as liability insurance, property insurance, and workers’ compensation, to protect your business from potential risks.

Factors Affecting Insurance Premiums

Several factors influence the cost of insurance premiums, including your age, location, the coverage type, your health status, and your driving history. It’s essential to understand how these factors can affect your insurance costs and explore ways to mitigate them.

Making the Right Insurance Choices

Choosing the right insurance coverage is a critical decision. It’s essential to assess your specific needs and financial situation to determine the most suitable policies for you and your family.

Comparing Insurance Quotes

When exploring insurance coverage options, it’s advisable to obtain multiple quotes from different insurers. Comparing these quotes will help you find the best coverage at the most competitive price.

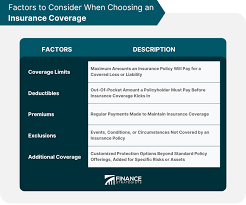

Importance of Coverage Limits

Understanding the coverage limits of your policy is crucial. It’s vital to ensure that your coverage adequately protects you without overpaying for unnecessary features.

Claim Process and Settlement

Knowing how to initiate a claim and the settlement process is vital. In case of an incident, being aware of the steps to follow can expedite the reimbursement process.

The Role of Insurance Agents

Insurance agents can be valuable resources in helping you find the right coverage. They provide expert advice and assist you in tailoring insurance packages to your needs.

Common Insurance Myths Debunked

There are several misconceptions about insurance. We’ll debunk some common myths, providing you with a more accurate understanding of the insurance industry.

Balancing Cost and Coverage

Finding the right balance between cost and coverage is essential. You want insurance that meets your needs without breaking the bank.

Understanding Policy Exclusions

Insurance policies often have exclusions that specify what is not covered. It’s essential to be aware of these exclusions to avoid surprises when making a claim.

Importance of Regular Policy Reviews

Your life and circumstances change over time. Regularly reviewing your insurance policies ensures that your coverage remains relevant and up to date.

Additional Coverage Options

Umbrella Insurance

Umbrella insurance provides an extra layer of protection that can be a financial lifesaver in case of unexpected events. Suppose you find yourself facing a costly lawsuit or an accident where you’re liable for damages that exceed the limits of your standard insurance policies. In that case, umbrella insurance steps in to cover the excess costs, safeguarding your assets, including your savings, investments, and even your home. It’s a smart choice for those who want added peace of mind, as it’s relatively affordable compared to the protection it offers.

Pet Insurance

Our pets are cherished members of our families, and their health is a top priority. Pet insurance is designed to ensure that your furry or feathered friends receive the best possible care when they fall ill or get injured. It covers a range of expenses, including veterinary bills, surgeries, medications, and even some preventive treatments. With pet insurance, you won’t have to make difficult decisions about your pet’s health based on financial considerations. Instead, you can focus on providing the care they need.

Flood Insurance

While home insurance covers various types of damage, it typically doesn’t include protection against floods. For those living in flood-prone areas, flood insurance is a must-have. Floods can cause extensive and expensive damage to your property. With flood insurance, you can recover the costs associated with flood-related damages, helping you rebuild and get back on your feet after a disaster. Be sure to check with your insurance agent to determine whether you’re in a flood zone and require this additional coverage.

Disability Insurance

Your ability to earn an income is a valuable asset. Disability insurance steps in when an illness or injury leaves you unable to work. It provides a portion of your income, ensuring you can meet your financial commitments even when you’re not able to work. This insurance offers peace of mind and financial security during challenging times, making it a wise investment for individuals of all ages.

Business Insurance

Entrepreneurs and business owners face unique risks that can impact their ventures and livelihoods. Business insurance encompasses various coverage types, such as liability insurance, property insurance, and workers’ compensation. It’s tailored to protect your business from a range of risks, including lawsuits, property damage, or workplace accidents. Having the right business insurance can make the difference between the success and failure of your enterprise.

Factors Affecting Insurance Premiums

The cost of insurance premiums can vary significantly from person to person and policy to policy. Understanding the factors that affect your premiums can help you find ways to save money and get the coverage you need:

- Age: Younger individuals typically pay higher premiums, especially for auto insurance, as they are considered more at risk of accidents. As you gain more experience and maintain a clean driving record, your premiums may decrease.

- Location: Where you live can impact your insurance rates. Urban areas with high traffic and crime rates may have higher premiums compared to rural or suburban locations.

- Coverage Type: The type and amount of coverage you choose will directly influence your premiums. More comprehensive coverage will come with higher costs.

- Health Status: For health and life insurance, your age, current health condition, and medical history will be considered. Good health may lead to lower premiums.

- Driving History: Your driving record plays a significant role in determining auto insurance rates. Accidents, traffic violations, and claims can increase your premiums.

It’s essential to shop around, compare quotes, and consider these factors to find the right insurance coverage that suits your needs and budget.

Making the Right Insurance Choices

Selecting the right insurance coverage is a crucial decision. It’s not a one-size-fits-all scenario. Your choices should align with your specific needs and financial situation. Consider your family size, your assets, and any unique circumstances that might require specialized coverage. Consulting with an insurance agent can be a valuable step in helping you make informed decisions. They can assess your situation and recommend appropriate policies to provide you with the protection you need.

Comparing Insurance Quotes

Obtaining insurance quotes from multiple providers is a prudent approach. It allows you to compare costs, coverage, and available discounts. Keep in mind that the cheapest option isn’t always the best, as it might not provide the level of protection you require. Balance cost considerations with the coverage offered, and don’t hesitate to ask questions to ensure you understand what’s included in each policy.

Importance of Coverage Limits

Understanding the coverage limits of your policy is crucial to ensuring you have adequate protection. While it’s tempting to opt for the minimum coverage to save on premiums, this may leave you exposed in the event of a significant loss. On the other hand, excessively high coverage can be costly and unnecessary. Striking the right balance is key. Consult with your insurance agent to determine the appropriate coverage limits based on your assets and liabilities.

Claim Process and Settlement

Knowing the steps involved in filing a claim and the settlement process can save you time and frustration in the event of a covered incident. Most insurance companies have a claims department that guides policyholders through the process. Be sure to document the incident and communicate promptly with your insurer to expedite the settlement. Understanding your policy’s details will also help you know what to expect during the claims process.

The Role of Insurance Agents

Insurance agents are knowledgeable professionals who can help you navigate the complex world of insurance. They can explain policy terms, coverage options, and discounts, making it easier for you to make informed choices. A good agent will prioritize your needs, ensuring you get the best value for your insurance dollars.

Common Insurance Myths Debunked

There are several myths surrounding insurance that can lead to confusion and misinformed decisions. Let’s debunk some of these myths to provide you with a clearer understanding of how insurance works:

Myth 1: You only need the minimum required coverage. While it’s tempting to opt for minimum coverage to save money, it might not be enough to protect your assets adequately. Assess your specific needs and consider higher coverage limits if necessary.

Myth 2: Insurance agents always prioritize their commissions over your needs. Reputable insurance agents are committed to finding the right coverage for you, not just the most expensive policy. Building long-term relationships with clients is often more valuable than a one-time commission.

Myth 3: Insurance is a waste of money. Insurance provides valuable protection against unexpected events. While you hope never to use it, it can be a financial lifesaver when you need it most.

Myth 4: Insurance covers all types of damage or loss. Policies often have exclusions and limitations. It’s crucial to read and understand your policy to know what is and isn’t covered.

Myth 5: Insurance premiums can’t be negotiated. Insurance premiums can sometimes be negotiated or reduced through discounts and adjustments to your policy. It’s worth discussing with your insurer or agent.

Balancing Cost and Coverage

Finding the right balance between cost and coverage is essential when choosing insurance policies. It’s tempting to focus solely on cost, but skimping on coverage could leave you vulnerable. Consider your financial situation, assets, and what you can afford, and choose coverage that aligns with your specific needs. A well-balanced insurance policy offers peace of mind without overstretching your budget.

Understanding Policy Exclusions

Most insurance policies have exclusions or situations that are not covered. It’s crucial to be aware of these exclusions to avoid unpleasant surprises when you need to make a claim. Exclusions can vary widely depending on the type of insurance and the policy provider.

For example, in health insurance, certain pre-existing conditions may be excluded from coverage for a waiting period. In auto insurance, intentional damage or actions while using your vehicle for commercial purposes may be excluded. Home insurance may have exclusions for specific types of natural disasters, such as earthquakes or floods, and may require separate policies for such coverage.

To understand the exclusions in your policy, carefully review your policy documents or consult with your insurance agent. It’s vital to be informed about what your insurance won’t cover, so you can make plans accordingly and explore additional coverage if necessary.

Importance of Regular Policy Reviews

Life is dynamic, and your insurance needs can change over time. What was suitable for you a few years ago may no longer meet your requirements today. Significant life events, such as marriage, the birth of a child, a new job, or the acquisition of valuable assets, can alter your insurance needs.

Regular policy reviews are essential to ensure that your coverage remains up to date and relevant. An annual review, for instance, provides an opportunity to make necessary adjustments, add or remove coverage, and take advantage of discounts. Additionally, reviewing your policies can help you stay within your budget while maintaining the level of protection you need.

Insurance Coverage Options: A Comprehensive Guide

Additional Considerations

With a comprehensive understanding of insurance coverage options, it’s important to delve deeper into a few additional considerations that can help you navigate the world of insurance more effectively.

Deductibles and Premiums

One key factor in insurance is the deductible, which is the amount you must pay out of pocket before your insurance coverage kicks in. Generally, policies with lower deductibles come with higher premiums (the regular payments you make for your insurance). Conversely, policies with higher deductibles often have lower premiums. Understanding this balance is essential. A lower deductible means you pay less when making a claim, but your regular premiums will be higher. A higher deductible reduces your regular payments but means you’ll have to cover more of the cost in case of a claim. Consider your financial situation and risk tolerance when choosing the right balance for you.

Bundling Policies

Many insurance companies offer discounts for bundling multiple insurance policies. For example, if you purchase both auto and home insurance from the same provider, you might be eligible for a discount. Bundling can save you money and simplify your insurance management, making it a smart choice for many.

Policy Riders and Add-Ons

Most insurance policies offer additional options known as riders or add-ons. These allow you to customize your coverage to better suit your unique needs. For instance, in health insurance, you might want to add a maternity rider if it’s not included in your basic policy. In auto insurance, you can include roadside assistance or rental car coverage. While these riders can enhance your coverage, they also add to your premiums, so it’s essential to choose them wisely.

Shopping Around

Don’t settle for the first insurance policy you come across. Shopping around is crucial to finding the best coverage at the most competitive price. There are numerous insurance providers, each with their own set of policies, discounts, and features. Get quotes from multiple companies and take your time to compare them. Make sure to evaluate the coverage details, deductibles, limits, and any exclusions to make an informed choice.

Risk Management

Effective risk management is an essential aspect of insurance. By taking steps to reduce risks, you can often lower your premiums. For example, in auto insurance, maintaining a clean driving record and attending defensive driving courses can result in lower premiums. In home insurance, improving your home’s security with alarms and fire safety measures can have a similar effect. Discuss risk management options with your insurer or agent to see how they can impact your coverage.

Review and Update Your Coverage

Your insurance needs can change over time. Marriage, the birth of children, career changes, and new assets all require adjustments to your coverage. Regularly reviewing your policies ensures that they continue to meet your current needs. If significant life events occur, reach out to your insurance provider or agent to discuss necessary updates.

Final Thoughts

Insurance coverage options are designed to provide security and peace of mind in an unpredictable world. With the right combination of policies, you can protect yourself, your loved ones, and your assets. It’s not just a matter of having insurance but having the right insurance for your specific circumstances.

In this comprehensive guide, we’ve covered the basics of various insurance types, explored the factors affecting your premiums, and provided tips on making informed choices. It’s essential to understand that insurance is not one-size-fits-all. Your choices should align with your unique situation and financial goals.

As you move forward in your insurance journey, remember that the key to success is staying informed, reviewing your policies, and seeking expert advice when necessary. The world of insurance is vast, and making the right decisions requires a level of expertise that insurance agents and professionals can provide.

So, whether you’re securing your health, your car, your home, your family, or your business, take the time to assess your needs, explore your options, and make informed choices. It’s an investment in your financial well-being and your peace of mind.

Conclusion

In conclusion, insurance coverage options are an integral part of your financial strategy. They offer you a safety net, peace of mind, and financial protection against life’s unexpected events. Understanding the various types of insurance available, being aware of the factors that influence your premiums, and making informed choices are all crucial aspects of managing your insurance needs effectively.

By delving into the nuances of insurance coverage and staying informed about the options available, you can make confident decisions that ensure you, your loved ones, and your assets are adequately protected.

Remember, insurance is not just about securing your assets; it’s about safeguarding your peace of mind and your financial future. The right insurance coverage can be the difference between financial security and financial turmoil during challenging times.

5 Unique FAQs

- Can I change my insurance coverage during the policy term?

- Yes, you can often make changes to your policy, but it’s essential to understand any associated fees or limitations.

- What factors can increase my auto insurance premiums?

- Factors like accidents, traffic violations, and adding a new driver to your policy can lead to premium increases.

- Is life insurance necessary if I don’t have dependents?

- While life insurance is essential for those with dependents, it can also serve as an investment or inheritance tool for single individuals.

- Are insurance agents biased towards specific companies?

- Insurance agents may have preferences, but a good agent should prioritize your needs and budget over any particular insurer.

- How often should I review my insurance policies?

- It’s a good practice to review your policies annually or when significant life changes occur, such as marriage, childbirth, or major purchases.

Don’t underestimate the importance of insurance in your financial portfolio. It’s a fundamental component that provides protection and ensures you’re prepared for the unexpected.

So, whether you’re considering health, auto, home, life, or any other type of insurance, take the time to explore your options, assess your needs, and make informed choices. Insurance is not just a safety net; it’s a crucial part of securing your financial well-being and your future.