Invoice factoring service has emerged as a valuable financial tool for businesses looking to bridge the cash flow gap and maintain their operations smoothly. In this comprehensive guide, we will explore the intricacies of invoice factoring, how it works, its benefits, and how your business can access this invaluable financial solution.

1. Understanding Invoice Factoring

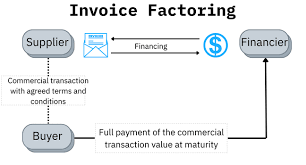

Invoice factoring service, also known as accounts receivable factoring, is a financial arrangement where a business sells its outstanding invoices to a third-party financial institution, known as a factoring company or factor. This transaction allows the business to receive immediate cash, typically a percentage of the invoice’s face value, while the factoring company assumes responsibility for collecting payment from the customers.

2. How Does Invoice Factoring Work?

The process of invoice factoring service is straightforward:

- A business delivers goods or services to its customers and generates invoices.

- The business sells these invoices to a factoring company.

- The factoring company advances a certain percentage of the invoice amount, usually between 70% to 90%, to the business.

- The factoring company takes over the responsibility of collecting payment from the customers.

- Once the customers pay the full invoice amount, the factoring company remits the remaining balance to the business, deducting a fee for its services.

3. Types of Invoice Factoring

3.1 Recourse Factoring

In recourse factoring, the business retains some level of responsibility for unpaid invoices. If customers fail to pay, the business must repurchase the invoices from the factoring company.

3.2 Non-Recourse Factoring

Non-recourse factoring provides greater protection to the business. If a customer defaults on payment, the factoring company absorbs the loss, and the business is not required to repurchase the invoice.

4. Advantages of Invoice Factoring

- Improved cash flow: Invoice factoring provides immediate cash, helping businesses meet their financial obligations and seize growth opportunities.

- No debt incurred: Unlike traditional loans, factoring does not create debt on the business’s balance sheet.

- Access to expertise: Factoring companies are skilled in credit analysis and collections, reducing the risk of bad debts.

- Flexible financing: Factoring lines can grow with your business, making it an adaptable financing solution.

5. When Should You Consider Invoice Factoring?

- Your business experiences cash flow gaps due to slow-paying customers.

- You need to take advantage of supplier discounts or early payment opportunities.

- Traditional bank financing is unavailable or insufficient.

- Your business is growing rapidly and requires working capital.

6. Choosing the Right Invoice Factoring Company

Selecting the right factoring partner is crucial. Consider factors like fees, reputation, customer service, and industry expertise when making your choice.

7. The Application Process

Applying for invoice factoring typically involves providing financial documents, customer invoices, and business information to the factoring company. The approval process is usually faster than traditional loans.

8. Factors Affecting Factoring

Factoring rates depend on various factors, including the industry, customer creditworthiness, and the volume of invoices factored.

9. Common Misconceptions About Factoring

Addressing common myths about factoring can help businesses make informed decisions.

10. Case Studies: Real-Life Success Stories

Explore how businesses have leveraged invoice factoring to overcome financial challenges and thrive.

11. Risks and Limitations

Understanding the potential risks and limitations of invoice factoring service is essential for making informed financial decisions.

12. Alternatives to Factoring

Discover alternative financing options, such as lines of credit, business loans, or equity financing.

13. FAQs About Invoice Factoring Service

Q1: Is invoice factoring only for struggling businesses? Q2: What is the cost of invoice factoring? Q3: How long does it take to get approved for invoice factoring? Q4: Can businesses in any industry benefit from factoring? Q5: What happens if customers don’t pay their invoices after factoring?

FAQs About Invoice Factoring

Q1: Is invoice factoring only for struggling businesses? Invoice factoring is not exclusively for struggling businesses. It is a financing option that can benefit businesses of all sizes, including those looking to seize growth opportunities or maintain consistent cash flow.

Q2: What is the cost of invoice factoring? The cost of invoice factoring varies based on factors such as the factoring company’s fees, the creditworthiness of your customers, and the volume of invoices factored. Typically, factoring fees range from 1% to 5% of the invoice amount.

Q3: How long does it take to get approved for invoice factoring? The approval process for invoice factoring is generally faster than traditional loans. It can take a few days to a couple of weeks, depending on the factoring company’s processes and the completeness of your application.

Q4: Can businesses in any industry benefit from factoring? While many industries can benefit from invoice factoring, the suitability of this financing option may vary. Factoring companies often specialize in specific industries, so it’s essential to choose a partner with expertise in your field.

Q5: What happens if customers don’t pay their invoices after factoring? If customers fail to pay their invoices after factoring, the factoring company may pursue collections. In recourse factoring, the business may be required to repurchase the invoices from the factoring company. However, in non-recourse factoring, the factoring company absorbs the loss, and the business is not held responsible for the unpaid invoice.

Invoice factoring is a dynamic financial tool that offers businesses the flexibility and liquidity they need to navigate the challenges of today’s competitive marketplace. It allows companies to focus on their core operations while leaving the task of managing accounts receivable and chasing overdue payments to the experts.

One of the key advantages of invoice factoring is that it is not a loan, and it doesn’t create debt on the business’s balance sheet. Instead, it leverages the value of outstanding invoices, turning them into immediate working capital. This can be especially beneficial for businesses with seasonal fluctuations in cash flow or those that need to invest in growth initiatives.

Moreover, invoice factoring provides businesses with access to professional credit analysis and collections services. Factoring companies specialize in assessing the creditworthiness of customers and have the expertise to recover funds from slow-paying or delinquent accounts. This can significantly reduce the risk of bad debts and improve the overall financial health of a business.

When should you consider invoice factoring for your business? Here are some scenarios where it can be a valuable financing solution:

- Cash Flow Gaps: If your business frequently experiences cash flow gaps due to slow-paying customers, invoice factoring can provide the necessary funds to cover operational expenses and seize growth opportunities.

- Early Payment Discounts: Many suppliers offer discounts for early payment. With invoice factoring, you can take advantage of these discounts and potentially reduce your procurement costs.

- Limited Access to Traditional Financing: If your business has been turned down for traditional bank loans or has limited access to other forms of financing, invoice factoring can offer an alternative source of working capital.

- Rapid Growth: Growing businesses often require additional working capital to support their expansion efforts. Invoice factoring can provide the necessary funds to fuel growth without taking on debt.

Selecting the right invoice factoring company is critical to the success of this financing strategy. When choosing a partner, consider the following factors:

- Fees: Different factoring companies have varying fee structures. It’s essential to understand the fees associated with factoring and how they will impact your business’s profitability.

- Reputation: Research the reputation and track record of the factoring company. Reading reviews and seeking referrals from other businesses can provide valuable insights.

- Customer Service: Good communication and support are vital when dealing with a factoring partner. Ensure that the company offers responsive and helpful customer service.

- Industry Expertise: Some factoring companies specialize in specific industries. Look for a partner with experience in your industry, as they will better understand your unique needs.

- Flexibility: Choose a factoring partner that offers flexible terms and can adapt to your business’s changing financial requirements.

The application process for invoice factoring service is generally straightforward and faster than traditional loan applications. Businesses typically need to provide financial documents, customer invoices, and basic information about their operations. Once approved, the factoring company will advance a percentage of the invoice amount, typically ranging from 70% to 90%, within a short timeframe.

It’s important to note that the specific rate at which invoices are factored can vary based on several factors, including the industry, the creditworthiness of your customers, and the volume of invoices you plan to factor. Factoring rates typically fall within the range of 1% to 5% of the invoice amount.

While invoice factoring service offers numerous benefits, it’s essential to be aware of the potential risks and limitations:

- Cost: Factoring fees can add up, especially if your business relies heavily on factoring. It’s crucial to evaluate the overall cost and compare it to the benefits received.

- Customer Relationships: When working with a factoring company, they will interact with your customers for payment collection. This change in the billing process can impact customer relationships, so it’s important to choose a factoring partner that maintains professionalism and transparency in customer interactions.

- Not Suitable for All Industries: While many businesses can benefit from invoice factoring, some industries may find it less suitable due to the nature of their contracts or customer relationships. It’s important to assess whether factoring aligns with your industry’s dynamics.

- Business Size: Factoring may not be the ideal solution for very small businesses or startups with limited invoices to factor.

14 Conclusion

Invoice factoring service can be a game-changer for businesses seeking a reliable and flexible source of working capital. By understanding how it works, its benefits, and the factors to consider when choosing a factoring partner, you can make informed financial decisions to support your business’s growth.