Introduction

Welcome to the world of financial freedom and flexibility with Rollover IRA brokerage accounts. In this informative guide, we’ll explore the ins and outs of these accounts, shedding light on their advantages, strategies, and key considerations. Whether you’re planning for retirement or aiming to optimize your investment portfolio, a Rollover IRA brokerage account could be the perfect solution.

The Rollover IRA Brokerage Account

Unlocking Financial Potential

If you’ve recently changed jobs or are looking to take control of your retirement savings, a Rollover IRA brokerage account is a powerful financial tool at your disposal. This account type allows you to seamlessly transfer your retirement funds from your previous employer’s retirement plan into a self-directed account.

What Is a Rollover IRA Brokerage Account?

A Rollover IRA brokerage account is a tax-advantaged retirement account that permits you to move funds from your old employer-sponsored retirement plan, such as a 401(k), into an individual retirement account (IRA). This transition enables you to manage your investments more flexibly.

The Benefits of a Rollover IRA Account

- Tax Advantages: Rollover IRAs offer tax-deferred growth, allowing your investments to grow without immediate tax consequences.

- Diverse Investment Options: With a brokerage account, you can invest in a wide range of assets, including stocks, bonds, mutual funds, and more.

- Control and Flexibility: You gain complete control over your investments and can make decisions that align with your financial goals.

- Consolidation: Simplify your financial life by consolidating retirement accounts from multiple employers into one Rollover IRA.

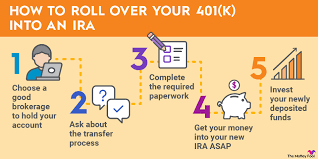

How to Open a Rollover IRA Brokerage Account

Taking the First Step

Opening a Rollover IRA brokerage account is a straightforward process, but it’s essential to do it correctly to maximize its benefits.

Step 1: Choose a Brokerage Firm

Research and select a reputable brokerage firm that offers Rollover IRA accounts. Consider factors such as fees, investment options, and customer service.

Step 2: Contact Your Previous Employer

Reach out to your former employer’s HR department to initiate the rollover process. They will provide the necessary paperwork and guidance.

Step 3: Fund Your Rollover IRA

Transfer your funds from your old retirement account to your new Rollover IRA brokerage account. This can usually be done via a direct transfer or a check made out to your new account.

Step 4: Start Investing

Once your funds are in the Rollover IRA, you’re ready to begin building your investment portfolio. Consult with a financial advisor if needed to create a diversified strategy that aligns with your goals.

Strategies for Maximizing Your Rollover IRA Account

Making the Most of Your Investments

Now that you have your Rollover IRA brokerage account set up, let’s explore some strategies for optimizing your retirement savings.

1. Asset Allocation

Diversify your investments across various asset classes to manage risk effectively. Consider a mix of stocks, bonds, and other securities that align with your risk tolerance and time horizon.

2. Regular Contributions

Make consistent contributions to your Rollover IRA to benefit from the power of compounding over time. Even small, regular investments can grow significantly.

3. Rebalance Your Portfolio

Periodically review and rebalance your investment portfolio to ensure it aligns with your goals and risk tolerance. This prevents overexposure to certain assets.

4. Tax-Efficient Withdrawals

Plan your withdrawals strategically to minimize tax implications. Consult with a tax advisor to create a tax-efficient distribution strategy during retirement.

5. Stay Informed

Stay updated on financial markets and investment trends. A well-informed investor can make more confident decisions.

Tax Considerations for Rollover IRA Account

Minimizing Tax Impact

Understanding the tax implications of your Rollover IRA is crucial for long-term financial planning. Here’s what you need to know:

Tax-Deferred Growth

One of the primary advantages of a Rollover IRA is tax-deferred growth. This means your investments can grow without immediate taxation. You only pay taxes when you withdraw funds during retirement, ideally at a lower tax bracket.

Roth Conversion

If you anticipate being in a higher tax bracket during retirement, consider a Roth IRA conversion. This involves paying taxes on the converted amount now to enjoy tax-free withdrawals in retirement.

Required Minimum Distributions (RMDs)

Once you reach the age of 72, you must start taking required minimum distributions from your Rollover IRA. Failing to do so can result in hefty penalties. Make sure to plan for these distributions to avoid surprises.

Rollover IRA Account vs. Traditional IRA Account

Choosing the Right Account

While a Rollover IRA has its benefits, it’s essential to understand how it differs from a Traditional IRA.

Rollover IRA Account

- Best for individuals with old employer-sponsored retirement plans.

- Permits rollovers from 401(k)s, 403(b)s, and other similar plans.

- No income limits for contributions.

- Tax-deferred growth.

Traditional IRA Account

- Open to anyone with earned income.

- Contributions may be tax-deductible, depending on income and other factors.

- Tax-deferred growth.

- No age limit for contributions, but RMDs start at age 72.

Choosing between the two depends on your specific circumstances and financial goals.

Rollover IRA Brokerage Account Success Stories

Real-Life Inspiration

To truly appreciate the potential of a Rollover IRA brokerage account, let’s delve into some success stories:

Mary’s Early Retirement Dream

Mary, a 55-year-old professional, decided to roll over her 401(k) into a Rollover IRA brokerage account. With the flexibility to invest in a diversified portfolio, she saw her retirement savings grow steadily. At 62, she retired comfortably, thanks to her well-managed Rollover IRA.

David’s Tax-Efficient Strategy

David had a high-paying job and knew he’d be in a lower tax bracket in retirement. He opted for a Roth conversion within his Rollover IRA, paying taxes upfront to enjoy tax-free withdrawals later. This strategic move saved him a significant amount in taxes during retirement.

Sarah’s Legacy Planning

Sarah had multiple old retirement accounts scattered across former employers. By consolidating them into a single Rollover IRA brokerage account, she simplified her financial life and ensured a smoother inheritance process for her children.

FAQs (Frequently Asked Questions)

Q: Can I have more than one Rollover IRA brokerage account?

Yes, you can have multiple Rollover IRA accounts, but it’s essential to keep track of them and ensure they align with your overall financial strategy.

Q: Are there any penalties for early withdrawals from a Rollover IRA?

Yes, there can be penalties for early withdrawals before the age of 59½, in addition to income tax. However, certain exceptions apply, such as for first-time home purchases and educational expenses.

Q: Can I rollover a Roth 401(k) into a Rollover IRA brokerage account?

Yes, you can rollover a Roth 401(k) into a Rollover IRA, but keep in mind that the funds will be subject to taxation upon conversion.

Q: What is the maximum contribution limit for a Rollover IRA?

The annual contribution limit for a Rollover IRA may change over time due to inflation adjustments. Consult the IRS website for the most current limits.

Q: Is it possible to convert a traditional IRA into a Rollover IRA?

Yes, you can convert a traditional IRA into a Rollover IRA. This process is known as a traditional-to-Rollover IRA conversion.

Q: What happens to my Rollover IRA if I change jobs again?

Your Rollover IRA remains intact and under your control. You can choose to leave it as is, roll it over into a new employer’s retirement plan, or perform another rollover.

Conclusion

In the world of financial planning, a Rollover IRA brokerage account shines as a beacon of opportunity. Its tax advantages, investment flexibility, and potential for growth make it a powerful tool for securing your retirement. With the right strategies and careful planning, you can embark on a path toward financial freedom and peace of mind.