Introduction

Selling Structured Settlement Payments are financial arrangements that provide a series of periodic payments to individuals who have successfully settled a legal claim. While these settlements are designed to provide long-term financial security, life circumstances can change, leading some recipients to explore the option of selling their structured settlement payments. In this comprehensive guide, we will delve into the process of selling structured settlement payments, exploring the reasons behind such decisions, the steps involved, potential benefits, and important considerations.

Understanding Selling Structured Settlement Payments

Structured settlements are often the result of legal settlements, lottery winnings, or other financial awards. They are designed to provide a steady income stream over an extended period, ensuring that the recipient has a reliable source of funds. However, life is unpredictable, and financial needs may evolve over time.

Reasons to Consider Selling Structured Settlement Payments

There are various reasons individuals may choose to sell their structured settlement payments. These can include unexpected medical expenses, the desire to invest in a home or education, starting a business, or addressing other pressing financial needs. Understanding your specific financial goals is crucial in determining if selling structured settlement payments is the right decision for you.

The Process of Selling Structured Settlement Payments

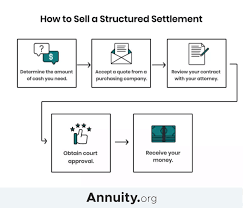

Selling structured settlement payments involves a legal process that requires court approval. The process generally includes the following steps:

a. Evaluation of Payments: Determine the total value of your structured settlement payments.

b. Choose a Buyer: Research and select a reputable structured settlement purchasing company.

c. Legal Assistance: Engage a lawyer experienced in structured settlements to guide you through the legal process.

d. Court Approval: File a petition with the court to request approval for the sale. The court will review your financial situation and assess whether the sale is in your best interest.

e. Receive Lump Sum: Upon court approval, you will receive a lump sum payment from the purchasing company.

Benefits of Selling Structured Settlement Payments

While the decision to sell structured settlement payments is a significant one, it can offer several benefits, including:

a. Immediate Financial Relief: Access to a lump sum can provide immediate relief for pressing financial needs.

b. Investment Opportunities: The lump sum can be used for investments, such as starting a business, purchasing a home, or furthering education.

c. Flexibility: Selling structured settlement payments provides financial flexibility, allowing recipients to adapt to changing circumstances.

Important Considerations

Before deciding to sell structured settlement payments, it is crucial to consider the following factors:

a. Long-Term Impact: Selling structured settlement payments may affect your long-term financial stability, so it’s important to carefully weigh the pros and cons.

b. Legal Assistance: Engaging a qualified attorney specializing in structured settlements is essential to navigate the complex legal process.

c. Credibility of Buyers: Research potential buyers thoroughly to ensure they are reputable and transparent about the terms of the transaction.

d. Court Approval: Understand that court approval is required for the sale, and the court will prioritize your best interests.

Potential Risks and Drawbacks

While selling structured settlement payments can offer immediate financial benefits, it is essential to be aware of potential risks and drawbacks. These may include:

a. Discount Rates: Buyers often apply discount rates to the total value of the structured settlement payments. This means you may receive a lump sum that is less than the total future payments.

b. Higher Long-Term Costs: In some cases, the overall cost of selling structured settlement payments, when considering discount rates and fees, can be higher than the immediate financial relief it provides.

c. Financial Planning Disruption: Selling structured settlement payments can disrupt the original financial plan created with the settlement. It’s crucial to reassess and adjust your financial goals accordingly.

d. Tax Implications: Depending on the nature of your structured settlement, selling payments may have tax implications. Consult with a tax professional to understand the potential tax consequences.

Alternatives to Selling Structured Settlement Payments

Before deciding to sell, consider exploring alternatives that may meet your financial needs without selling your structured settlement payments. Some alternatives include:

a. Financial Counseling: Seek the guidance of a financial counselor to explore budgeting strategies and financial planning.

b. Loan Options: Investigate the possibility of obtaining a loan as an alternative to selling structured settlement payments.

c. Government Assistance Programs: Research available government assistance programs that may provide financial support for specific needs.

d. Negotiate with the Original Payer: In some cases, it may be possible to negotiate with the original payer to modify the terms of the structured settlement to better suit your current needs.

Post-Sale Considerations

After selling structured settlement payments, it’s important to manage the lump sum wisely. Consider the following post-sale considerations:

a. Financial Planning: Reevaluate your financial goals and create a new financial plan that aligns with your current situation.

b. Invest Wisely: If you plan to invest the lump sum, do thorough research or consult with a financial advisor to make informed investment decisions.

c. Debt Repayment: If part of your motivation for selling was to address debts, prioritize debt repayment to improve your financial stability.

d. Emergency Fund: Consider allocating a portion of the lump sum to establish or bolster an emergency fund for unexpected expenses.

Conclusion

In conclusion, selling structured settlement payments is a significant financial decision that should not be taken lightly. While it offers the advantage of immediate access to funds, recipients must carefully consider the long-term impact on their financial well-being. Seeking legal advice and thoroughly researching potential buyers are crucial steps in ensuring a smooth and transparent process.

However, the decision to sell structured settlement payments is a complex one that requires careful consideration of various factors. While it can provide immediate financial relief, it comes with potential risks and drawbacks. Individuals must weigh these factors against their specific financial needs and explore alternatives before proceeding with a sale. Seeking professional advice, both legal and financial, is crucial throughout the process to ensure a well-informed decision.

FAQs

Q1: Can I sell only a portion of my structured settlement payments? Yes, it is possible to sell only a portion of your structured settlement payments. This is known as a partial sale, and the process involves selling a specific number of future payments while retaining the rest.

Q2: How long does the process of selling structured settlement payments take? The timeline for selling structured settlement payments varies, but it typically takes several weeks to a few months. Factors such as court processing times and the complexity of your case can influence the duration.

Q3: Will selling structured settlement payments affect my credit score? No, selling structured settlement payments does not impact your credit score. This transaction is not reported to credit bureaus, and it is a separate financial arrangement.

Q4: Are there any restrictions on how I can use the lump sum payment? In most cases, there are no restrictions on how you can use the lump sum payment. It can be used for any purpose, including paying off debts, investing, purchasing a home, or covering medical expenses.

Q5: Can I sell my structured settlement payments if I live in a different state from where the settlement was established? Yes, it is possible to sell structured settlement payments across state lines. However, it’s important to consult with an attorney familiar with the laws of both your current residence and the state where the settlement was established.