Understanding the Definition of Tax Exemption

In the complex world of finance and taxation, the term “tax exemption” often arises, leaving many individuals puzzled about its significance and implications. To demystify this concept, we’ll embark on a journey to uncover tax exemption definition, explore its various forms, and gain insights into its importance in personal and corporate finance. So, let’s dive into the world of taxes and exemptions, shall we?

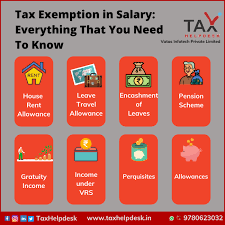

1. What is Tax Exemption?

Tax exemption is a legal provision that allows certain individuals, organizations, or entities to reduce or completely eliminate their obligation to pay taxes on specific types of income, transactions, or assets. Essentially, it provides a form of financial relief by reducing the overall tax burden for eligible parties.

2. Types of Tax Exemptions

Individual Tax Exemptions

Individuals can often benefit from various forms of tax exemptions, such as those related to charitable contributions, retirement savings, and certain educational expenses. These exemptions are designed to incentivize behaviors that promote societal well-being and financial security.

Corporate Tax Exemptions

Corporations may also be eligible for tax exemptions, particularly when engaging in activities that align with government policies or support economic development. These exemptions can significantly impact a company’s bottom line.

3. Qualifications and Eligibility

To qualify for tax exemptions, individuals and organizations must meet specific criteria outlined by tax authorities. These criteria may include income thresholds, compliance with relevant regulations, and adherence to specific reporting requirements.

4. Benefits of Tax Exemption

this offer several advantages, including reduced tax liabilities, increased financial flexibility, and the ability to allocate resources to specific goals, such as philanthropy or business expansion.

5. Tax-Exempt Organizations

Certain entities, like non-profit organizations and religious institutions, enjoy tax-exempt status to encourage charitable activities and community support. This status allows them to receive donations and grants without incurring tax obligations on these funds.

6. Common Misconceptions

There are often misconceptions surrounding tax exemptions, with some individuals believing they are entirely exempt from paying any taxes. In reality, tax exemptions are specific to certain areas and types of income.

7. Tax Exemption vs. Tax Deduction

It’s essential to differentiate between tax exemption definition and tax deduction. While both can reduce tax liabilities, tax deductions subtract eligible expenses from taxable income, whereas tax exemptions directly reduce the tax owed.

8. Tax Exemption Across the Globe

Tax exemption laws vary from one country to another, reflecting different economic and social priorities. Studying international tax policies can offer valuable insights into the broader implications of tax exemptions.

9. Controversies Surrounding Tax Exemption

The allocation of tax exemptions can be a contentious topic, with debates over fairness, transparency, and the impact on government revenue. Understanding these controversies is crucial for informed discussions on tax policy.

10. Filing for Tax Exemptions

Individuals and organizations must follow specific procedures and documentation requirements to claim tax exemptions successfully. Failing to do so may result in penalties or the loss of exempt status.

11. The Impact on the Economy

this can influence economic growth, investment, and job creation. Governments must carefully consider the consequences of their tax policies on the overall economy.

12. Recent Changes in Tax Exemption Laws

Tax laws are subject to change, and recent updates may impact who qualifies for exemptions and under what conditions. Staying informed about legislative changes is essential for maximizing tax benefits.

13. The Future of Tax Exemption

The landscape of tax exemption is continually evolving. Emerging trends, such as digital taxation and environmental incentives, are shaping the future of tax policies around the world.

14. Tax Exemption Planning

Individuals and businesses can engage in tax exemption planning to optimize their financial strategies. Consulting with tax professionals and staying informed about tax law changes are essential components of effective planning.

15. Conclusion

In conclusion, understanding the definition of tax exemption is crucial for individuals, businesses, and policymakers alike. It plays a pivotal role in shaping financial decisions, economic policies, and the overall well-being of society. By navigating the intricate world of tax exemptions, individuals and organizations can make informed choices that align with their financial goals and contribute to the greater good.

16. Tax Exemption and Social Impact

One of the critical aspects of tax exemptions is their potential to drive positive social change. Governments often grant tax-exempt status to organizations that engage in activities benefiting society. This includes non-profit organizations, charities, and educational institutions. By offering tax incentives to these entities, governments encourage philanthropic endeavors, the advancement of education, and the provision of essential services.

17. The Role of Charitable Contributions

Charitable organizations play a significant role in leveraging tax exemptions for the greater good. When individuals or corporations make donations to qualified non-profit organizations, they can often claim deductions or tax credits. This serves as an incentive for people to contribute to causes they believe in while simultaneously reducing their tax liabilities.

18. Tax Exemption in Real Estate

In the realm of real estate, tax exemptions can be a powerful tool. Many jurisdictions offer property tax exemptions to homeowners, particularly for primary residences. These exemptions help make homeownership more affordable and can provide much-needed financial relief for families.

19. The Complexity of Tax Exemption Laws

These laws can be intricate and vary significantly from one jurisdiction to another. It’s essential for individuals and businesses to seek professional advice when navigating these complexities. Tax professionals can help maximize available exemptions while ensuring compliance with all applicable regulations.

20. The Ethical Debate

The allocation of tax exemptions can lead to ethical debates. Some argue that certain exemptions favor specific industries or interest groups, potentially leading to inequities in the tax system. This debate underscores the importance of transparency and accountability in tax policy development.

21. The Global Perspective

As the world becomes increasingly interconnected, understanding tax exemption laws on a global scale is crucial, especially for multinational corporations. International tax agreements and treaties can impact a company’s eligibility for exemptions and deductions, making compliance a complex but necessary endeavor.

22. Tax Exemptions for Retirement

In many countries, individuals can enjoy tax exemptions on retirement savings. Contributions to retirement accounts, such as 401(k)s and IRAs in the United States, are often tax-deductible or eligible for tax credits. These incentives encourage individuals to save for their future financial security.

23. Navigating Tax Exemptions

For individuals and businesses alike, navigating the labyrinth of tax exemptions requires careful planning and consideration. It’s advisable to maintain detailed financial records, stay updated on tax law changes, and collaborate with tax professionals who can provide expert guidance.

24. The Evolving Tax Landscape

The world of taxation is constantly evolving, driven by changes in technology, economic conditions, and societal priorities. Staying informed and adaptable is essential for effectively utilizing tax exemptions and deductions.

Frequently Asked Questions (FAQs)

- What’s the primary purpose of tax exemptions?

- this aim to reduce or eliminate tax obligations for eligible individuals and organizations, encouraging specific behaviors or activities.

- Are tax exemptions the same as tax deductions?

- No, tax exemptions and tax deductions are distinct. Tax exemptions directly reduce the tax owed, while tax deductions subtract eligible expenses from taxable income.

- How do tax exemptions impact the economy?

- this can influence economic growth, investment, and job creation, but their impact varies based on the specific exemption and its implementation.

- Can tax exemptions change over time?

- Yes, tax exemption laws can change due to legislative updates, shifts in government priorities, or economic developments.

- What steps should I take to qualify for a tax exemption?

- To qualify for a tax exemption, you should consult relevant tax authorities, meet eligibility criteria, and ensure proper documentation and compliance with regulations.

Understanding tax exemptions is a vital aspect of financial literacy and responsible financial management. By grasping the intricacies of this concept, individuals and businesses can navigate the tax landscape more effectively and make informed financial decisions.

Conclusion

In conclusion, tax exemption is a multifaceted concept that touches upon various aspects of our financial lives. From encouraging charitable giving to supporting economic growth, tax exemptions play a pivotal role in shaping our financial decisions and the broader economy. While navigating the intricacies of tax exemptions can be challenging, the rewards in terms of reduced tax liabilities and financial flexibility are well worth the effort.

As you continue to explore the world of taxation and exemptions, remember that staying informed and seeking professional advice when needed are key strategies for optimizing your financial situation.