Introduction

In this article User Insurance Company Departments, we will delve into the intricacies of these departments, exploring their significance, key roles, technological integration, challenges faced, and strategies for improvement. Insurance is a critical aspect of financial planning and risk management, providing individuals and businesses with a safety net in times of uncertainty. Within the realm of insurance, user insurance company departments play a pivotal role in understanding, addressing, and fulfilling the diverse needs of policyholders.

Understanding User Needs

User Insurance Company Departments are at the forefront of comprehending the unique requirements of policyholders. Whether it’s a young professional seeking health coverage or a business owner safeguarding assets, these departments analyze user profiles to tailor insurance policies that align with individual needs.

Tailoring Policies for Users

One of the primary responsibilities of these departments is crafting policies that cater to the specific needs of users. This involves assessing risk factors, determining coverage limits, and ensuring that policyholders have a comprehensive understanding of their insurance plans.

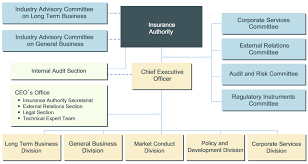

Key Roles within User Insurance Company Departments

Within these departments, various roles contribute to the seamless functioning of insurance services. Customer service representatives, claims adjusters, and underwriters are key players in ensuring policyholders receive prompt and efficient assistance.

Customer Service Representatives

These frontline professionals are the face of user insurance companies. They assist users in understanding policy details, addressing queries, and providing assistance during the claims process. Effective communication and empathy are crucial skills in this role.

Claims Adjusters

Claims adjusters play a vital role in evaluating the validity of claims. Their expertise in assessing damage, estimating costs, and negotiating settlements ensures a fair and timely resolution for policyholders.

Underwriters

Responsible for evaluating risk, underwriters make informed decisions about policy approval and premium rates. Their role is pivotal in maintaining a balance between protecting the company’s interests and offering competitive insurance packages.

Technology Integration in User Insurance

The landscape of user insurance is evolving rapidly, with technology playing a central role in enhancing services and customer experiences.

AI and Machine Learning in User Insurance

Artificial Intelligence (AI) and machine learning algorithms are employed to analyze user data, predict risks, and streamline underwriting processes. This not only improves efficiency but also allows for more accurate risk assessments.

Mobile Apps for User Engagement

User insurance companies leverage mobile apps to engage with policyholders. These apps provide easy access to policy information, enable quick claims processing, and offer personalized communication, enhancing the overall user experience.

Challenges Faced by User Insurance Company Departments

While user Insurance Company Departments strive to provide optimal services, they face various challenges in the ever-evolving landscape.

Adapting to Changing User Needs

User needs and expectations evolve with time. Insurance departments must continuously adapt their offerings to align with changing demographics, technological trends, and societal shifts.

Cybersecurity Concerns

As user insurance becomes increasingly digitized, the risk of cybersecurity threats grows. Protecting sensitive user data and ensuring the integrity of digital systems are constant challenges that these departments must address.

Strategies for Improving User Insurance Services

To overcome challenges and enhance user satisfaction, user insurance companies employ various strategies.

Personalized Communication

Effective communication is key to building trust. User insurance companies invest in personalized communication strategies to keep policyholders informed about policy updates, industry trends, and risk management tips.

Streamlining Claim Processes

Simplifying and expediting the claims process is a priority. User insurance companies leverage technology to automate and streamline claims processing, reducing the time it takes for policyholders to receive settlements.

The Future of User Insurance company Departments

The future of user insurance holds exciting possibilities, driven by technological advancements and a focus on sustainability.

Innovations in Coverage Options

Insurance companies are exploring innovative coverage options, such as parametric insurance and on-demand coverage, to provide more flexibility and tailored solutions for users.

Sustainability in User Insurance

With a growing emphasis on environmental consciousness, user insurance companies are integrating sustainability into their practices. This includes offering eco-friendly coverage options and supporting environmental initiatives.

Case Studies: Successful User Insurance Company Departments

Examining successful user insurance companies provides insights into best practices and strategies for excellence.

Company A: Revolutionizing Customer Service

By implementing advanced customer relationship management (CRM) systems, Company A achieved significant improvements in customer service. Prompt responses, personalized interactions, and proactive communication set them apart.

Company B: Embracing Technological Advancements

Company B embraced cutting-edge technologies, such as blockchain for secure transactions and data integrity. This commitment to innovation enhanced trust among policyholders and positioned them as leaders in the industry.

Ensuring Transparency in User Insurance company Departments

Transparency is a cornerstone of trust in the insurance industry.

Transparent Policy Terms

User insurance companies are adopting clear and transparent policy terms, ensuring that users fully understand the details of their coverage. This transparency fosters trust between the insurance company and the policyholder, reducing the likelihood of disputes and misunderstandings.

Clear Communication Practices

In addition to transparent policy terms, user insurance companies prioritize clear communication practices. This includes providing easily accessible information, using plain language in documents, and offering educational resources to help users make informed decisions about their coverage.

User Insurance Company Departments and Social Responsibility

Beyond providing financial protection, user insurance companies recognize their role in contributing to social responsibility.

Community Outreach Programs

Many User Insurance company Departments actively engage in community outreach programs. This involvement may include sponsoring local events, supporting charitable causes, and participating in initiatives that enhance the well-being of the communities they serve.

Environmental Initiatives

Acknowledging the impact of their operations on the environment, some user insurance companies are incorporating eco-friendly practices. This involves adopting sustainable business processes, reducing carbon footprints, and even offering discounts for policyholders with environmentally conscious lifestyles.

Tips for Choosing the Right User Insurance Company

Selecting the right user insurance company is a crucial decision that requires careful consideration.

Assessing Coverage Needs

Before choosing an insurance provider, individuals should assess their coverage needs. Understanding the specific risks they face enables them to select a policy that offers adequate protection.

Researching Company Reputation

Researching the reputation of user insurance companies is essential. Reading customer reviews, checking ratings from independent agencies, and seeking recommendations can provide valuable insights into the company’s reliability and customer satisfaction.

Common Misconceptions about Insurance Company Departments

Dispelling common misconceptions about user insurance is essential for fostering a better understanding of its importance.

All Policies Are the Same

Contrary to a widespread belief, not all insurance policies are the same. User insurance companies offer a range of coverage options, and individuals should carefully choose policies that align with their unique needs and circumstances.

Insurance Is Only for the Wealthy

Another misconception is that insurance is only for the wealthy. In reality, insurance is a tool that anyone, regardless of financial status, can use to protect themselves and their assets from unexpected events.

How Insurance Company Departments Adapt to Technological Trends

Staying ahead of technological trends is crucial for user insurance departments to provide efficient and up-to-date services.

Cyber Insurance in the Digital Age

Given the increasing frequency of cyber threats, user insurance companies are introducing cyber insurance to protect individuals and businesses from the financial implications of cyberattacks.

Integrating IoT for Risk Assessment

The Internet of Things (IoT) is revolutionizing risk assessment. User insurance companies are leveraging IoT devices, such as smart home sensors and wearable devices, to gather real-time data for more accurate risk evaluations.

The Human Touch in User Insurance

While technology plays a significant role, the human touch remains indispensable in user insurance.

Building Trust through Personal Interactions

Personal interactions, whether in person or through customer service channels, contribute to building trust. Knowing there’s a human element behind the insurance process reassures policyholders.

Empathy in Claims Processing

Empathy in claims processing is vital. Understanding the emotional toll of a loss or damage, user insurance professionals approach claims with compassion, making the process more humane for policyholders.

Conclusion

In conclusion, user insurance company departments are dynamic entities that continuously evolve to meet the ever-changing needs of policyholders. From leveraging cutting-edge technologies to embracing social responsibility, these departments play a crucial role in safeguarding individuals and businesses against uncertainties. As users navigate the complex landscape of insurance options, understanding the key roles, technological trends, and strategies employed by user insurance companies becomes essential.

Frequently Asked Questions (FAQs)

- Is all insurance the same, or are there different types tailored to individual needs?

- Insurance comes in various types, each designed to address specific needs. It’s crucial to choose a policy that aligns with your unique circumstances.

- Do User Insurance company Departments only focus on financial protection, or do they contribute to social responsibility as well?

- Many User Insurance company Departments actively engage in social responsibility initiatives, such as community outreach programs and environmental initiatives.

- How do user insurance companies use technology to enhance their services?

- User insurance companies leverage technology, including AI, machine learning, and IoT, to streamline processes, enhance user experiences, and stay ahead of emerging risks.

- Are insurance policies only for the wealthy?

- No, insurance is a tool accessible to everyone, providing a financial safety net regardless of individual financial status.

- What should individuals consider when choosing the right User Insurance company Departments?

- When choosing an insurance provider, individuals should assess their coverage needs, research the company’s reputation, and consider factors such as transparency and communication practices.