Introduction

In the dynamic landscape of business, choosing the right financial partner is crucial. Westpac Business Account offers a range of business accounts tailored to diverse needs, ensuring entrepreneurs have the financial support they require. Let’s dive into the intricacies of Westpac business accounts and why making the right choice is paramount.

Types of Westpac Business Accounts

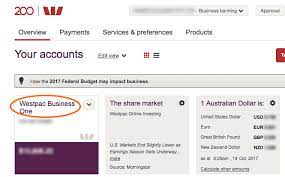

Business One

Westpac’s Business One account is designed for small businesses, providing essential banking services with minimal fees.

Business One High Plan

For businesses with higher transaction volumes, the Business One High Plan offers additional features and benefits.

Business Flexi

The Business Flexi account caters to businesses with fluctuating financial needs, offering flexibility in managing cash flow.

Business Interest Account

Ideal for businesses with surplus funds, the Business Interest Account provides competitive interest rates on deposited funds.

Features and Benefits of Using Westpac Business Account

With competitive interest rates, transparent fee structures, and convenient online banking, Westpac’s business accounts stand out.

Competitive Interest Rates

Westpac offers competitive interest rates on savings, helping businesses maximize their returns.

Fee Structure Analysis

A detailed analysis of fees ensures businesses are aware of costs, promoting financial planning and control.

Online Banking Convenience

Westpac’s online banking platform provides businesses with 24/7 access, facilitating efficient financial management.

Merchant Services Integration

Integration with merchant services streamlines payment processing, enhancing business operations.

Eligibility and Application Process for Westpac Business Account

Navigating the application process is simplified with clear eligibility criteria and step-by-step online application guidance.

Eligibility Criteria

Understanding the eligibility criteria ensures businesses apply for the account that best suits their needs.

Required Documentation

Gathering necessary documentation is a crucial step in the application process, emphasizing transparency and compliance.

Online Application Steps

The online application process is designed for convenience, allowing businesses to apply at their own pace.

Case Studies

Real-life success stories highlight the impact of choosing the right Westpac business account, showcasing businesses that have thrived with tailored financial solutions.

Success Stories of Businesses Using Westpac Accounts

Explore inspiring stories of businesses that have grown and succeeded with Westpac’s financial support.

Challenges Overcome with the Right Account Choice

Discover how businesses faced and overcame challenges by selecting the most suitable Westpac business account.

Tips for Maximizing Your Westpac Business Account

Practical tips empower businesses to make the most of their Westpac accounts, optimizing transactions and leveraging online tools.

Optimizing Transaction Usage

Strategic use of transactions ensures businesses capitalize on the benefits offered by their Westpac account.

Leveraging Online Tools

Westpac provides a suite of online tools; businesses can harness these tools for enhanced financial management and decision-making.

Connecting with Westpac Support

Accessing support services ensures businesses have guidance and assistance when needed.

Security Measures in Westpac Business Accounts

A robust security framework protects businesses from cyber threats, including multi-layered authentication and proactive fraud prevention.

Multi-layered Authentication

Enhanced security measures, such as multi-layered authentication, safeguard businesses from unauthorized access.

Fraud Prevention Tools

Westpac’s advanced fraud prevention tools detect and prevent fraudulent activities, ensuring the security of business transactions.

User Education on Cybersecurity

Educational resources empower users to contribute to the security of their accounts by understanding and implementing best practices.

Comparisons with Other Business Accounts

An unbiased comparison with other business accounts provides businesses with the information needed to make an informed decision.

Analyzing Competitors

Comparative analysis sheds light on how Westpac’s offerings stack up against competitors in the business banking landscape.

Unique Features Setting Westpac Apart

Identifying the unique features of Westpac’s business accounts showcases the institution’s commitment to providing exceptional value.

Customer Reviews and Ratings

Insights from customer reviews offer a real-world perspective, addressing common concerns and providing valuable feedback.

Online Reviews Overview

An overview of online reviews gives businesses a sense of the overall customer satisfaction with Westpac’s business accounts.

Addressing Common Concerns

Transparently addressing common concerns from customer reviews demonstrates Westpac’s commitment to continuous improvement.

Future Trends in Business Banking

Anticipating future trends in business banking sheds light on the evolving landscape and how Westpac is positioned for the future.

In the ever-evolving landscape of business banking, staying ahead of the curve is vital for both financial institutions and the businesses they serve. Let’s explore the anticipated future trends in business banking and how Westpac is positioned to embrace these changes.

Technological Advancements

As we move forward, technology will play an increasingly pivotal role in shaping the business banking experience. Westpac, with its commitment to innovation, is expected to leverage emerging technologies to enhance services for its business account holders.

Artificial Intelligence (AI) Integration

AI-powered solutions are poised to revolutionize business banking by providing personalized insights, automating routine tasks, and enhancing fraud detection. Westpac’s proactive approach to adopting AI is likely to result in more intuitive and efficient banking experiences.

Blockchain for Secure Transactions

Blockchain technology is gaining traction for its ability to ensure secure and transparent transactions. Westpac may explore blockchain applications to fortify the security of business transactions, minimizing the risk of fraud and errors.

Anticipated Changes in Banking Policies

The regulatory landscape in banking is subject to constant evolution, and businesses need financial partners capable of adapting to these changes. Westpac, as a reputable institution, is expected to navigate evolving banking policies effectively.

Open Banking Implementation

Open banking initiatives are reshaping how financial data is shared and utilized. Westpac is likely to embrace open banking, fostering increased collaboration and providing businesses with more comprehensive financial insights.

Enhanced Data Privacy Measures

With data breaches becoming more sophisticated, stringent data privacy measures are anticipated. Westpac’s commitment to safeguarding customer information positions it well to implement robust data privacy protocols, ensuring the security of business data.

Conclusion

In conclusion, choosing a Westpac business account is a strategic decision that can contribute significantly to a business’s success. The range of accounts, coupled with innovative features and robust security measures, positions Westpac as a reliable financial partner for businesses of all sizes.

FAQs

How do I choose the right Westpac business account?

Choosing the right account involves assessing your business needs, transaction volumes, and future growth plans. Westpac’s customer support can assist in this decision-making process.

Can I switch my current business account to Westpac?

Yes, businesses can switch their current accounts to Westpac. The online application process includes