An auto quote is an estimate provided by an insurance company that outlines the cost of an insurance policy for your vehicle. It takes into account various factors, including your vehicle’s make and model, your driving history, and the type of coverage you require. Auto quotes are essential for several reasons:

How to Ensures Legal Compliance in Auto Quotes

One of the primary reasons for obtaining an auto quote is to comply with legal requirements. In most regions, having auto insurance is mandatory, and an auto quote is the first step towards meeting this obligation.

Financial Protection in Auto Quotes

Auto insurance provides financial protection in the event of accidents or damage to your vehicle. An auto quote helps you understand how much coverage you can get and at what cost, ensuring you’re financially prepared for unexpected events.

Tailored Coverage Auto Quotes

Auto quotes allow you to tailor your insurance coverage to your specific needs. Whether you need basic liability coverage or comprehensive protection, the quote helps you choose the right options.

Budget Planning in Auto Quotes

Knowing the cost of your insurance policy in advance allows for better budget planning. You can factor in insurance expenses when managing your overall financial obligations.

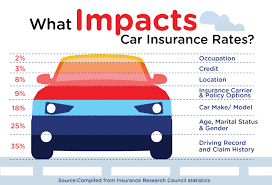

Factors Affecting Auto Quotes

Several factors influence the cost of an auto quote:

1. Vehicle Type

The make and model of your vehicle play a significant role in determining your auto insurance rate. High-performance and luxury cars typically come with higher premiums.

2. Driving History

Your driving record, including accidents and traffic violations, affects your quote. A clean record generally leads to lower rates.

3. Coverage Options

The type and extent of coverage you choose directly impact your auto quote. Comprehensive coverage costs more than basic liability insurance.

4. Deductibles

Higher deductibles mean lower premiums, but you’ll pay more out of pocket in the event of a claim.

5. Location

Your geographical location can influence your quote. Areas with higher rates of accidents or theft may lead to higher premiums.

How to Obtain an Auto Quote

Getting an auto quote is a straightforward process:

- Gather Information: Collect necessary details about your vehicle, driving history, and coverage preferences.

- Research Insurance Companies: Look for reputable insurance companies that offer auto quotes. You can often request quotes online or by phone.

- Provide Information: Fill out the required forms, providing accurate information about your vehicle and personal history.

- Review Options: Once you receive quotes, review them carefully. Compare rates and coverage to find the best fit for your needs.

- Ask Questions: Don’t hesitate to ask the insurance provider questions if you need clarification on any aspect of the quote.

- Purchase Insurance: Once you’ve made your decision, you can proceed to purchase the insurance policy.

The Benefits of Comparing Auto Quotes

1. Cost Savings in Auto Quotes

One of the most significant advantages of obtaining multiple auto quotes is the potential for cost savings. Different insurance providers offer varying rates for the same coverage. By comparing quotes, you can identify cost-effective options that fit your budget.

2. Customized Coverage in Auto Quotes

Each auto insurance provider may have unique policies and coverage options. Comparing quotes allows you to tailor your coverage to your specific needs. You can choose the level of protection that aligns with your preferences and circumstances.

3. Access to Discounts in Auto Quotes

Insurance companies often offer discounts based on factors like safe driving, bundling policies, or having safety features in your vehicle. By exploring multiple quotes, you can uncover potential discounts that can further reduce your premiums.

4. Evaluating Customer Service in Auto Quotes

Price is important, but so is the quality of service you’ll receive. When comparing auto quotes, take the opportunity to research each insurance company’s reputation for customer service. Look for reviews and ratings to gauge their responsiveness and support.

Understanding Auto Quote Terminology

1. Premium

The premium is the amount you pay for your insurance coverage, typically on a monthly or annual basis.

2. Deductible

The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Higher deductibles often result in lower premiums.

3. Coverage Limits

Coverage limits refer to the maximum amount your insurance company will pay for a claim. Understanding these limits is crucial to ensure you have adequate protection.

4. Comprehensive vs. Collision

Comprehensive coverage typically covers damage to your vehicle caused by factors other than collisions, such as theft, vandalism, or natural disasters. Collision coverage, on the other hand, covers damage resulting from accidents involving other vehicles or objects.

Auto Quotes and Your Financial Health

Obtaining and understanding auto quotes is not just about fulfilling legal requirements or protecting your vehicle; it’s also about safeguarding your financial health. Accidents and unexpected events can lead to significant expenses, and auto insurance serves as a safety net.

By actively seeking and comparing auto quotes, you can find the right balance between adequate coverage and affordability. This proactive approach can provide peace of mind, knowing that you are financially prepared for any unforeseen circumstances.

In conclusion, what is an auto quote is a fundamental question for any vehicle owner. It’s not just a legal requirement; it’s a tool for financial protection and peace of mind. By following the steps outlined in this guide, you can navigate the world of auto insurance with confidence, making informed decisions that benefit both your vehicle and your wallet.

FAQs about Auto Quotes

Q: Can I get an auto quote if I have a poor driving record? A: Yes, you can still obtain an auto quote, but it may result in higher premiums due to your driving history.

Q: How often should I get an auto quote? A: It’s a good idea to get quotes annually or when significant life changes occur, such as buying a new car or moving to a different area.

Q: Are online auto quotes accurate? A: Online quotes can provide a fairly accurate estimate, but it’s essential to provide accurate information for the best results.

Q: Can I negotiate the terms of my auto insurance based on the quote? A: While you can’t negotiate the quote itself, you can discuss your coverage options with the insurance provider to find a suitable policy.

Q: What is the minimum coverage required by law? A: The minimum coverage requirements vary by state or region, so it’s essential to check the specific regulations in your area.

Q: Do auto quotes affect my credit score? A: Requesting an auto quote typically does not impact your credit score. It’s considered a soft inquiry.

Conclusion

Understanding what is an auto quote and how it affects your insurance coverage is vital for every vehicle owner. It ensures you have the right protection in place and helps you make informed decisions about your insurance policy. Remember to obtain quotes from reputable insurance providers and review your options carefully.