Introduction

In this article Average Cost of Insurance Services, we will delve into the factors that influence insurance costs, debunk common myths, and provide practical tips for securing coverage without breaking the bank. Insurance, a financial safety net that provides peace of mind, has become an integral part of our lives. Whether it’s health, auto, home, or life insurance, understanding the average cost is crucial for making informed decisions.

Definition of Average Cost of Insurance Services

The Average Cost of Insurance Services encompasses a variety of coverage options designed to protect individuals, families, and businesses from financial losses. From unexpected medical expenses to car accidents and natural disasters, insurance offers a financial cushion when life takes an unexpected turn.

B. Importance of Insurance

The significance of insurance cannot be overstated. It not only provides financial security but also ensures that individuals can access necessary services without bearing the full brunt of the associated costs. However, this security comes at a price, and understanding the average cost is crucial for budget-conscious individuals.

Factors Influencing Average Cost of Insurance Services

A. Age and Gender

One of the primary factors influencing Average Cost of Insurance Services is age and gender. Younger individuals often face higher premiums, while gender can impact rates in certain types of insurance, such as auto coverage.

B. Type of Coverage

The type of coverage selected plays a significant role in determining costs. Comprehensive coverage generally comes with a higher price tag compared to basic plans.

C. Health History

In the realm of health insurance, individual health history can heavily influence costs. Pre-existing conditions and lifestyle choices may result in higher premiums.

D. Location

Where you live matters. Areas prone to natural disasters or with high crime rates often experience higher insurance costs across various categories.

Understanding Premiums on Average Cost of Insurance Services

A. Definition of Premiums

Premiums are the regular payments made to the insurance provider to maintain coverage. Understanding how premiums work is fundamental to grasping the overall cost of insurance.

B. How Premiums are Calculated

Insurance premiums are calculated based on a combination of risk factors. Insurers assess the likelihood of a claim being filed and adjust premiums accordingly.

C. Factors Impacting Premiums

Factors such as age, health status, and occupation all contribute to the complex formula used by insurers to determine premiums.

Average Cost Across Different Types of Insurance

A. Health Insurance

Health insurance costs can vary significantly based on factors like age, coverage type, and pre-existing conditions. Balancing cost and coverage is crucial in this realm.

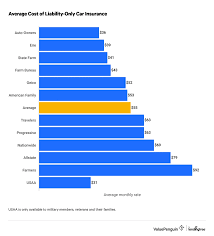

B. Auto Insurance

Auto insurance encompasses a wide range of factors, including driving history, vehicle type, and location. Exploring discounts and comparing quotes is key to finding affordable coverage.

C. Home Insurance

Home insurance costs are influenced by factors such as the home’s location, age, and safety features. Bundling home and auto insurance can lead to substantial savings.

D. Life Insurance

Life insurance costs depend on factors like age, health, and coverage amount. It’s essential to reassess life insurance needs at different life stages.

Ways to Reduce Insurance Costs

A. Bundling Policies

Consolidating multiple insurance policies under one provider often results in discounts, providing a cost-effective strategy for policyholders.

B. Increasing Deductibles

Opting for higher deductibles can lead to lower premiums, but it’s essential to strike a balance that aligns with one’s financial capacity.

C. Improving Credit Score

Surprisingly, credit scores can impact insurance costs. Maintaining a good credit score can contribute to lower premiums.

D. Shopping Around for Quotes

Not all insurance providers offer the same rates. Taking the time to obtain and compare quotes ensures that you find the most cost-effective coverage.

Average Cost of Insurance Services Myths Debunked

A. “Cheaper is Always Better”

Choosing the cheapest insurance option may leave you underinsured. It’s essential to evaluate coverage comprehensively rather than solely focusing on cost.

B. “Insurance Costs Are Fixed”

Insurance costs are dynamic and subject to change. Regularly reviewing and adjusting coverage ensures that you are not overpaying.

C. “Young People Always Pay Less”

While age can impact premiums, young individuals may face higher costs due to risk factors associated with certain age groups.

Importance of Comparing Quotes

A. Different Quotes, Different Costs

Insurance costs can vary significantly between providers. Comparing quotes allows you to identify the most competitive rates.

B. How to Effectively Compare Quotes

Consider not only the price but also the coverage offered. A comprehensive policy at a slightly higher cost may provide better value in the long run.

Tips for Lowering Average Cost of Insurance Services

A. Maintaining a Good Driving Record

A clean driving record is a valuable asset when seeking affordable auto insurance. Safe driving habits can lead to discounts.

B. Regular Health Checkups

Prioritizing health through regular checkups can positively impact health insurance costs by preventing the escalation of potential issues.

C. Home Security Measures

Implementing security measures in your home, such as alarm systems, can lead to lower home insurance premiums.

D. Lifestyle Changes

Certain lifestyle choices, such as quitting smoking or participating in wellness programs, may result in reduced insurance costs.

Balancing Average Cost of Insurance Services and Coverage

A. Finding the Right Balance

Striking a balance between affordable premiums and adequate coverage is a delicate but essential task for any insurance consumer.

B. Avoiding Underinsurance

While cutting costs is important, underinsurance can lead to financial strain in the event of a claim. Assessing

the level of coverage needed based on individual circumstances ensures protection without unnecessary financial burden.

The Future of Average Cost of Insurance Services

A. Technological Advancements

Advancements in technology, such as telematics in auto insurance or wearable devices in health insurance, are likely to reshape how insurers assess risk. This evolution could impact costs in the future.

B. Changing Trends in the Insurance Industry

Shifting trends in consumer behavior and preferences may influence the types of insurance products available and their associated costs. Staying informed about industry changes is vital for making cost-effective decisions.

Conclusion

In conclusion, understanding the Average Cost of Insurance Services is a crucial aspect of responsible financial planning. From health and auto to home and life insurance, the factors influencing costs are diverse and dynamic. By dispelling common myths, exploring cost-saving strategies, and staying vigilant about changing industry trends, individuals can navigate the complex landscape of Average Cost of Insurance Services.

In this era of financial uncertainty, being informed about the average cost of insurance services empowers individuals to make wise decisions that align with their budget and coverage needs. Remember, the key is not just finding the cheapest option but striking a balance between affordability and comprehensive protection.

FAQs (Frequently Asked Questions)

- Q: Can I negotiate insurance premiums? A: While negotiating may not be as common as in other industries, you can inquire about available discounts or explore bundling options to potentially lower your premiums.

- Q: How often should I review my insurance coverage? A: It’s advisable to review your coverage annually or whenever significant life events occur, such as marriage, the birth of a child, or major purchases.

- Q: Does my credit score really affect my insurance costs? A: Yes, some insurers consider credit scores when determining premiums. Maintaining a good credit score can positively impact your insurance costs.

- Q: Are online quotes accurate? A: Online quotes provide a good starting point, but for accurate and personalized estimates, it’s recommended to directly contact insurance providers.

- Q: Is it better to have higher or lower deductibles? A: The choice between higher or lower deductibles depends on your financial situation. While higher deductibles can lead to lower premiums, it’s crucial to ensure you can afford the deductible in case of a claim.