Introduction

Car Insurance Costs in Florida aren’t just a legal requirement; it’s a safeguard for the unexpected on the road. As you delve into the specifics, you’ll find that the cost of car insurance can vary significantly depending on where you live. In the Sunshine State, this variability is influenced by a myriad of factors, making it essential for residents to comprehend the intricacies of Car Insurance Costs in Florida.

Factors Influencing Car Insurance Costs in Florida

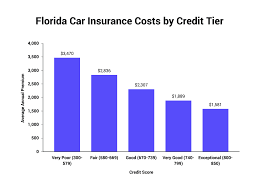

Car Insurance Costs in Florida are not arbitrary figures; they are carefully calculated based on several factors. Insurers take into account elements such as your driving record, age, and even credit score. In Florida, however, there are some unique factors that add an extra layer of complexity to the equation.

Average Cost of Car Insurance in Florida

According to recent statistics, the average Car Insurance Costs in Florida hovers around [specific figure]. This amount, though, is not a one-size-fits-all. To understand why your neighbor might be paying a different premium, it’s crucial to break down the components of this cost.

Breakdown of Coverage Types

Your insurance premium is not a lump sum but an amalgamation of various coverage types. From liability to comprehensive coverage, each type plays a role in determining your final cost. Understanding these components empowers you to make informed decisions about your coverage.

Comparison with National Averages

Is Florida’s car insurance cost higher than the national average? The answer is yes about Car Insurance Costs in Florida, and the reasons are multifaceted. Factors such as the state’s unique weather conditions, high-risk areas, and traffic patterns contribute to this disparity. Exploring these differences sheds light on why Florida residents may experience higher premiums.

Florida’s Unique Driving Conditions

Florida’s tropical climate isn’t just a selling point for tourists; it also poses challenges for drivers. From sudden rainstorms to the occasional hurricane threat, insurers factor in these risks when calculating your premium. Additionally, high-risk areas prone to accidents or theft can influence your insurance costs.

Discounts and Savings Opportunities

While the Car Insurance Costs in Florida may be higher than the national average, residents can take advantage of various discounts and savings opportunities. Insurers often provide discounts for safe driving, bundling policies, and even having a certain type of car. Knowing about and utilizing these discounts can significantly reduce your premium.

Legal Requirements in Florida

Before diving into the intricacies of car insurance costs, it’s crucial to understand Florida’s legal requirements. The state mandates a minimum coverage level, and failure to comply can result in penalties. Knowing the legalities ensures you have the necessary coverage while avoiding any legal repercussions.

Consumer Tips for Lowering Costs

Worried about the high cost of car insurance in Florida? Fret not. There are practical steps you can take to lower your premiums. Maintaining a clean driving record, taking advantage of discounts, and shopping around for the best rates are just a few strategies that can make a significant impact.

Understanding Coverage Types

Not all coverage is created equal, and understanding the different types available is key to finding the right policy for you. From liability to collision coverage, each type serves a specific purpose. Tailoring your coverage to your individual needs ensures you have adequate protection without overpaying.

Shopping for the Best Rates

In the age of the internet, comparing insurance rates has never been easier. Online tools and resources allow you to efficiently compare quotes from different insurers, helping you find the best rates for your specific needs. Don’t settle for the first quote; shop around to secure the most competitive premium.

Insurance Premium Fluctuations

Insurance premiums are not static; they can fluctuate based on various factors. Understanding why your premium might change allows you to adapt and make informed decisions. From changes in your driving record to alterations in the economic landscape, staying aware of potential fluctuations is crucial.

Impact of Personal Factors

Your personal circumstances play a significant role in determining your insurance rates. Factors like age, gender, and marital status can impact your premium. Managing these factors to the best of your ability ensures you are not overpaying for coverage.

Navigating the Claims Process in Car Insurance Costs in Florida

No one wants to deal with a car accident, but understanding the claims process can make the experience smoother. From filing a claim to interacting with insurance adjusters, knowing the steps involved can alleviate stress during an already challenging time.

Importance of Regular Policy Reviews

As life changes, so do your insurance needs. Regularly reviewing your policy ensures that it aligns with your current situation. Whether you’ve moved, bought a new car, or experienced changes in your family, keeping your policy up to date is vital for adequate protection.

Conclusion

In conclusion, the Car Insurance Costs in Florida is influenced by a myriad of factors, both general and specific to the state. By understanding these factors, consumers can make informed decisions about their coverage, potentially saving money while ensuring they have the protection they need on the road.

Navigating the landscape of Car Insurance Costs in Florida requires a blend of knowledge, strategy, and awareness. While the average cost may be higher than the national average, understanding the unique factors at play empowers you to make informed decisions.

By comprehending the intricacies of coverage types, taking advantage of discounts, and staying aware of personal and state-specific factors, you can not only manage your expenses but also ensure you have the right level of protection on the road.