Introduction

In this article Cheapest Car Insurance in Philadelphia, we’ll delve into the intricacies of finding the cheapest car insurance in Philadelphia, providing insights, tips, and actionable advice. When it comes to car insurance, Philadelphia residents often find themselves on a quest for the most affordable options. In a city known for its rich history and diverse neighborhoods, navigating the world of car insurance can be both perplexing and overwhelming.

Understanding Cheapest Car Insurance in Philadelphia

Cheapest Car Insurance in Philadelphia is a financial safety net that protects you in the event of accidents or unforeseen circumstances. In Philadelphia, as in many places, car insurance is mandatory. Understanding the basics is crucial before embarking on the journey to find the Cheapest Car Insurance in Philadelphia. Coverage types vary, from liability to comprehensive, and Philadelphia has specific minimum requirements that drivers must meet.

Factors Affecting Car Insurance Rates

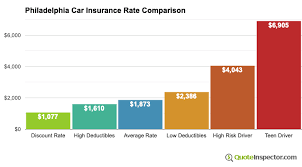

Several factors contribute to the cost of car insurance navigating the Cheapest Car Insurance in Philadelphia. Demographic details, driving history, and the type of coverage chosen all play a role. Philadelphia’s unique characteristics may impact rates differently compared to other cities. Being aware of these factors can empower residents to make informed decisions when seeking the most cost-effective insurance.

Shopping Around for the Best Rates for Cheapest Car Insurance in Philadelphia

Finding the cheapest car insurance involves diligent comparison shopping. Online tools and resources simplify this process, allowing residents to gather quotes from various providers quickly. Taking the time to compare rates can lead to substantial savings without sacrificing coverage quality.

Local Insurance Providers in Philadelphia

While national insurance companies are prevalent, exploring local options can yield surprising benefits. Local providers often tailor their services to the specific needs of the community, providing personalized attention and sometimes more competitive rates.

Discount Programs

Insurance companies offer various discounts that can significantly lower premiums. From safe driving discounts to bundling policies, understanding the available discount programs is essential for those seeking the most economical coverage.

Tips for Lowering Car Insurance Premiums

Implementing certain practices, such as maintaining a clean driving record and raising deductibles, can contribute to lower insurance premiums. This section provides practical tips for individuals looking to save on their car insurance costs and getting the Cheapest Car Insurance in Philadelphia.

Common Mistakes to Avoid as it affects the Cheapest Car Insurance in Philadelphia

In the pursuit of affordable insurance, it’s crucial to avoid common mistakes that could lead to suboptimal coverage or higher premiums. This section outlines pitfalls and offers guidance on steering clear of them.

Customer Reviews and Satisfaction

Customer reviews provide valuable insights into the experiences of others with specific insurance providers. Checking satisfaction ratings can help individuals gauge the quality of service and make informed decisions.

Insurance for Specific Demographics

Different demographics may have unique considerations when seeking affordable car insurance. Students, seniors, and low-income individuals may find tailored options that cater to their specific needs.

Importance of Customer Service

Beyond cost, the level of customer service offered by an insurance provider is paramount. This section emphasizes the impact of customer service on the overall insurance experience and guides readers on researching customer service ratings.

Understanding Policy Terms and Conditions

Reading and understanding the fine print is crucial when choosing car insurance. Transparency in policy terms and conditions ensures that there are no surprises when making a claim.

Case Studies

Real-life examples showcase individuals who successfully navigated the quest for the cheapest car insurance in Philadelphia. Learning from these experiences can inspire confidence and provide practical tips.

Future Trends in Car Insurance

The world of car insurance is evolving, with technological advancements and the rise of autonomous vehicles shaping the landscape. Understanding these future trends can help residents make forward-thinking decisions when selecting insurance and choosing the Cheapest Car Insurance in Philadelphia.

Conclusion

In conclusion, finding the cheapest car insurance in Philadelphia involves a strategic approach, considering various factors and staying informed about available options. By implementing the tips and insights provided in this article, residents can confidently secure affordable coverage without compromising on quality.

Frequently Asked Questions

- Q: Can I really find affordable car insurance in Philadelphia?

- A: Absolutely! By exploring local options, comparing quotes, and taking advantage of discounts, you can find budget-friendly coverage.

- Q: How can I lower my car insurance premiums?

- A: Maintaining a clean driving record, raising deductibles, and taking advantage of available discounts are effective ways to lower premiums.

- Q: Are local insurance providers reliable?

- A: Yes, many local providers offer reliable and personalized services. Reading customer reviews can help you gauge their reputation.

- Q: What are the common mistakes to avoid when choosing Cheapest Car Insurance in Philadelphia?

- A: Common mistakes include not comparing quotes, overlooking discounts, and not understanding policy terms. Be diligent to avoid these pitfalls.

- Q: What’s the future of car insurance in Philadelphia?

- A: The future involves technological advancements and changes driven by autonomous vehicles. Staying informed about these trends can help you make informed decisions.