Introduction

Choosing the right Deductible in Car Insurance is a balancing act between immediate financial considerations and long-term cost-effectiveness. By understanding your budget, risk tolerance, and driving habits, you can navigate this decision-making process with confidence.

Car insurance is a vital aspect of responsible vehicle ownership, providing financial protection in case of accidents, theft, or damage. Among the many terms associated with car insurance, the deductible stands out as a crucial element that policyholders need to comprehend fully.

What is a Deductible in Car Insurance?

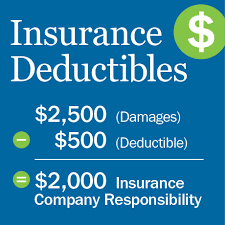

In the simplest terms, a deductible is the amount of money a policyholder is responsible for paying before their insurance coverage kicks in. This financial responsibility is a fundamental part of an insurance policy, influencing both the upfront costs and potential future claims.

How Deductibles Work

Imagine you’re involved in a car accident, and the repair costs amount to $3,000. If your Deductible in Car Insurance is $500, you must pay that amount out of pocket, and your insurance company covers the remaining $2,500. The Deductible in Car Insurance acts as a safeguard against small claims, ensuring that policyholders share in the financial responsibility.

Choosing the Right Deductible in Car Insurance

Selecting the appropriate Deductible in Car Insurance requires careful consideration. Factors such as budget constraints, risk tolerance, and driving habits all play a role in this decision-making process. Importantly, the chosen deductible directly impacts the cost of insurance premiums.

Factors to Consider When Choosing a Deductible

Choosing the right Deductible in Car Insurance involves a thoughtful analysis of your unique circumstances. Here are key factors to consider:

1. Budget Constraints

Evaluate your financial situation. While a higher Deductible in Car Insurance may lead to lower premiums, it also means a greater initial expense in case of a claim. Assess what you can comfortably afford in the event of an accident.

2. Risk Tolerance

Consider your risk tolerance. If you’re risk-averse and prefer a safety net for unforeseen events, a lower deductible might be preferable. However, if you’re comfortable taking on more risk to reduce monthly costs, a higher deductible could be suitable.

3. Driving Habits

Your driving habits play a role. If you’re a cautious driver with a clean record, you might be less likely to make a claim. In such cases, a higher deductible could be a strategic choice to lower overall costs.

4. Vehicle Value

The value of your vehicle matters. If you drive an older car with a lower market value, a higher deductible might make sense. For a high-value vehicle, a lower deductible could be justified to protect your investment.

Low vs. High Deductibles: Pros and Cons

The debate between low and high deductibles is a common dilemma for policyholders. Opting for a lower deductible means higher upfront costs but lower out-of-pocket expenses during a claim. On the other hand, choosing a higher deductible reduces monthly premiums but increases the financial burden in case of an incident.

Common Misconceptions about Deductibles

To make informed decisions, it’s essential to debunk common misconceptions about Deductible in Car Insurance. One prevalent myth is that a higher deductible always results in lower premiums. While this can be true, the relationship is not absolute and varies based on multiple factors.

Tips for Managing Deductible in Car Insurance Effectively

Managing deductibles effectively involves strategic planning. Policyholders can explore bundling insurance policies, taking advantage of discounts, and maintaining a good driving record to minimize overall costs while still having adequate coverage. Here are practical tips to navigate deductible decisions:

- Bundling Policies:

- Consider bundling car insurance with other policies for potential discounts.

- Maintaining a Good Driving Record:

- Safe driving can lead to lower overall costs and potentially influence deductible decisions.

- Reviewing Coverage Regularly:

- Periodically reassess your coverage needs and adjust deductibles accordingly.

Impact of Deductible in Car Insurance on Claims Process

Understanding how deductibles influence the claims process is vital for a smooth experience after an incident. The timing of reporting a claim, documentation, and communication with the insurance provider are all critical components of this process.

Understanding Deductible Limits

Every insurance policy comes with a maximum deductible limit, beyond which the insurance company takes over the entire financial responsibility. Knowing this limit is crucial to prevent unexpected financial burdens in the event of significant damages.

Deductibles and Policy Renewal

Policyholders need to stay informed about any changes in deductibles during policy renewal. Insurance providers may adjust deductibles based on various factors, and communication with the provider is key to understanding these changes.

How Deductibles Affect Premiums Over Time

The impact of deductibles on premiums is not static. As circumstances change, periodic reassessment of deductibles can help policyholders optimize their coverage while managing costs effectively.

Legal Implications of Deductibles

Compliance with legal requirements regarding deductibles is paramount. Understanding the legalities surrounding deductible adjustments ensures that policyholders operate within the bounds of the law.

Industry Trends in Deductible Structures

The insurance industry is dynamic, and deductible structures evolve over time. Policyholders should stay abreast of industry trends to capitalize on new offerings and ensure their coverage aligns with current standards.

Deductibles and Special Circumstances

Navigating deductibles in unique situations, such as accidents or natural disasters, requires a nuanced approach. Policyholders should be aware of any special considerations outlined in their policies to avoid surprises during challenging times.

Conclusion

In conclusion, understanding the meaning of Deductible in Car Insurance is pivotal for every policyholder. It empowers individuals to make informed decisions about their coverage, balancing financial considerations with the need for adequate protection. By grasping the intricacies of deductibles, one can navigate the complexities of car insurance with confidence.

FAQs about Deductibles in Car Insurance

- Q: Can I change my deductible at any time?

- A: Most insurance providers allow changes during policy renewal, but it’s advisable to check with your specific provider.

- Q: How does my deductible affect my monthly premium?

- A: Generally, a higher deductible leads to lower monthly premiums, while a lower deductible results in higher monthly costs.

- Q: Are all types of claims subject to a deductible?

- A: No, some policies waive deductibles for certain types of claims, such as windshield repair.

- Q: What happens if I can’t afford my deductible after an accident?

- A: Communicate with your insurance provider; they may offer solutions or flexible payment plans.

- Q: Can my deductible be higher than the repair cost?

- A: Yes, but in such cases, it’s generally more cost-effective to cover the repairs out of pocket.